Crypto Derivatives September’s Recap: Binance Futures Leading As BitMEX Down 30%

Although the cryptocurrency spot and derivatives trading volume declined on most platforms in September, Binance has taken the lead as the largest derivatives exchange, a new report revealed.

Simultaneously, the regulated Chicago Mercantile Exchange (CME) saw steady Bitcoin futures performance, while the options trading exploded.

Binance Takes The Top Spot For Derivatives Trading

The data analytics company CryptoCompare explores the performance of the most popular digital asset exchanges on a monthly basis. In the latest report for September, the document concluded that the trading activity among all platforms, regardless of spot or derivatives, declined substantially compared to August.

More precisely, the derivatives and spot volume decreased by 17.5% to $635 billion and $676.6 billion, respectively. Despite being lower than August, it’s worth noting that these numbers were higher than the two previous months – June and July.

However, the derivatives volume decline on Binance was among the lowest (-10.7%). Other popular names such as Huobi (-26%), OKEx (-18.5%), and BitMEX (-30.7%) marked more substantial decreases. As a result, Binance Futures, with its $165 billion trading volume, became the “largest derivatives exchange by volume” in September.

Binance Futures’ growth was further exemplified in mid-September when the exchange announced reaching $1 trillion in trading volume since the start of 2020.

Interestingly, FTX was the only derivatives exchange that saw an increase in the trading volume of 12%.

CME Bitcoin Options Trading Returns To High Ground

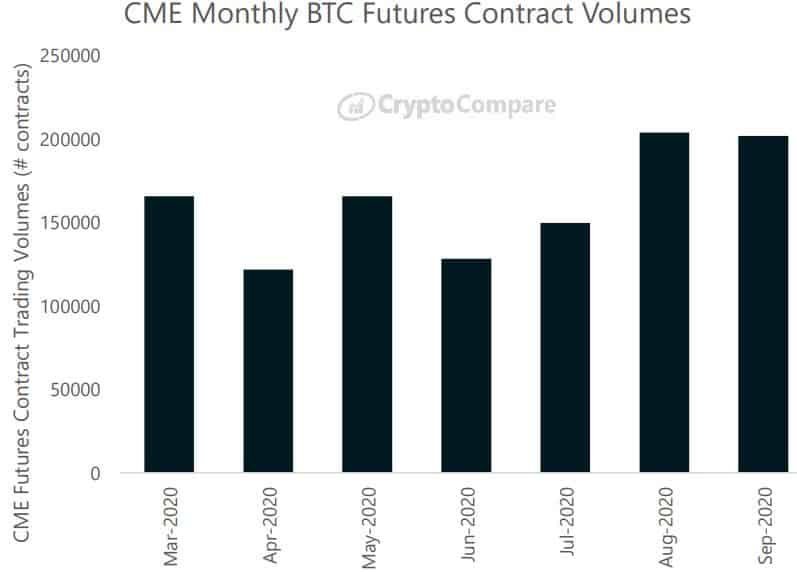

The Bitcoin futures contracts traded on the Chicago Mercantile Exchange (CME) remained relatively stable in September. The data from CryptoCompare indicated that the interest has been rather promising in the past few months. Nevertheless, August remains the month with the highest trading volume, with 203,867 contracts.

The situation with the Bitcoins options contracts was quite different in September compared to August.

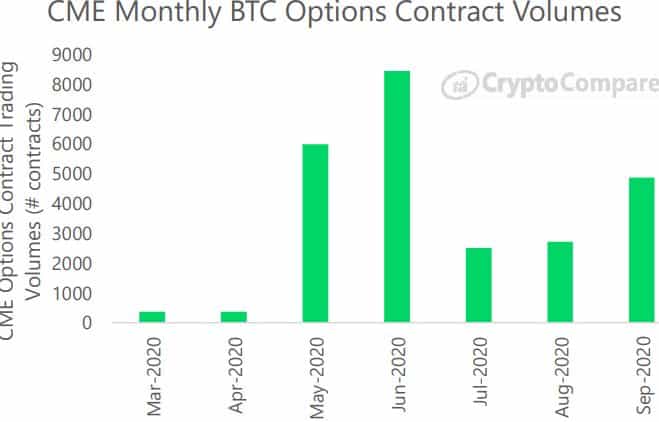

“CME options contract volumes experienced an increase of 79.4% in September to 4,872 contracts traded (vs. 2715 in August).”

The BTC options trading volumes on CME have been on a roller-coaster since the COVID-19 pandemic broke out. It displayed little-to-no action in March and April but then surged in May and especially June. July and August were relatively slow months, but it has skyrocketed once more in September, as CryptoCompare informed.

The post Crypto Derivatives September’s Recap: Binance Futures Leading As BitMEX Down 30% appeared first on CryptoPotato.