LINK Explodes 18% Daily, BTC Maintains $66K as Bitcoin ETF Inflows Continue (Market Watch)

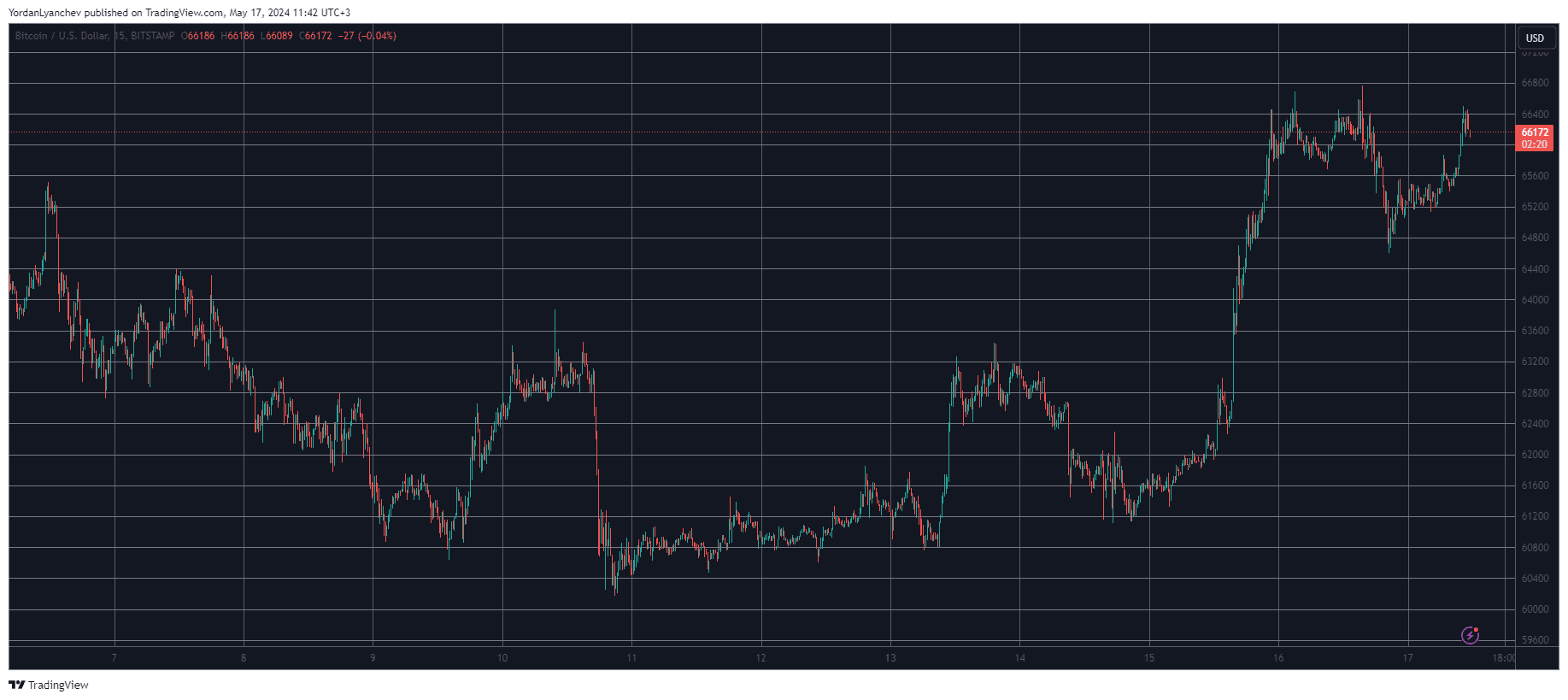

Bitcoin’s price tapped a multi-week high yesterday at around $66,600 before it was pushed down by about a grand but has reclaimed the $66,000 level as of now.

Several altcoins have continued their recent rally, with LINK taking the main stage following a massive 18% surge.

BTC Back to $66K

The primary cryptocurrency had a tough end of the previous business week when it was brought down to just inches above $60,000. Instead of going below that coveted round-numbered milestone, though, the asset bounced off during the weekend and especially on Monday.

The bulls initiated an impressive leg-up at the start of the current week that drove bitcoin to just over $63,000. It failed there at first, dropping to $61,200 amid some Coinbase issues, but went back on the offensive on Wednesday after the US announced the CPI numbers for April.

As the spot Bitcoin ETF inflows kept increasing on Wednesday and Thursday, BTC’s price soared to a three-week high of just over $66,500. The asset retraced slightly yesterday evening but has jumped back above $66,000 as of now amid the fourth consecutive day of positive flows into those ETFs.

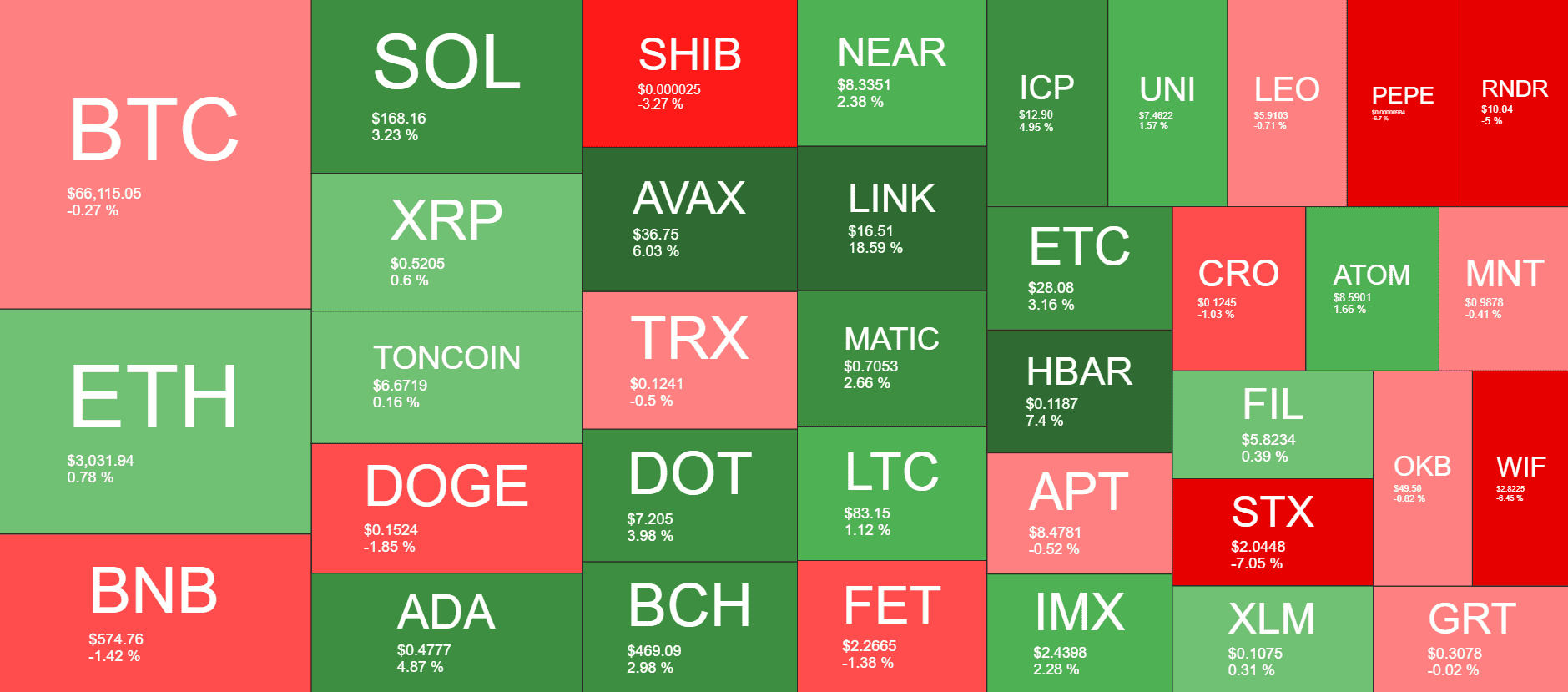

Its market cap remains slightly above $1.3 trillion, but its dominance over the alts has taken a hit and is down to 51.7%.

LINK Skyrockets

Most alternative coins turned green yesterday in a similar fashion to bitcoin. While some, such as BNB, DOGE, TON, TRX, and SHIB, are slightly in the red now, most others have kept climbing.

Ethereum and Ripple are up by 0.5-1%, which has helped the former maintain $3,000 and the latter $0.5. More gains come from the likes of SOL, ADA, AVAX, DOT, BCH, HBAR, and ICP.

However, Chainlink has stolen the show from the larger-cap alts. LINK has skyrocketed by more than 18% in the past day and now trades above $16.

The total crypto market cap has remained relatively still on a daily scale at just over $2.5 trillion on CG.

The post LINK Explodes 18% Daily, BTC Maintains $66K as Bitcoin ETF Inflows Continue (Market Watch) appeared first on CryptoPotato.