Bitcoin Closes Highest Daily Candle Since September 12th (Market Watch)

Bitcoin initiated another leg up in the past 24 hours and charted a new two-month high.

Several altcoins have also marked impressive gains in the past 24 hours, including MATIC, which tapped $1.2 earlier today.

Bitcoin’s New Local Peak

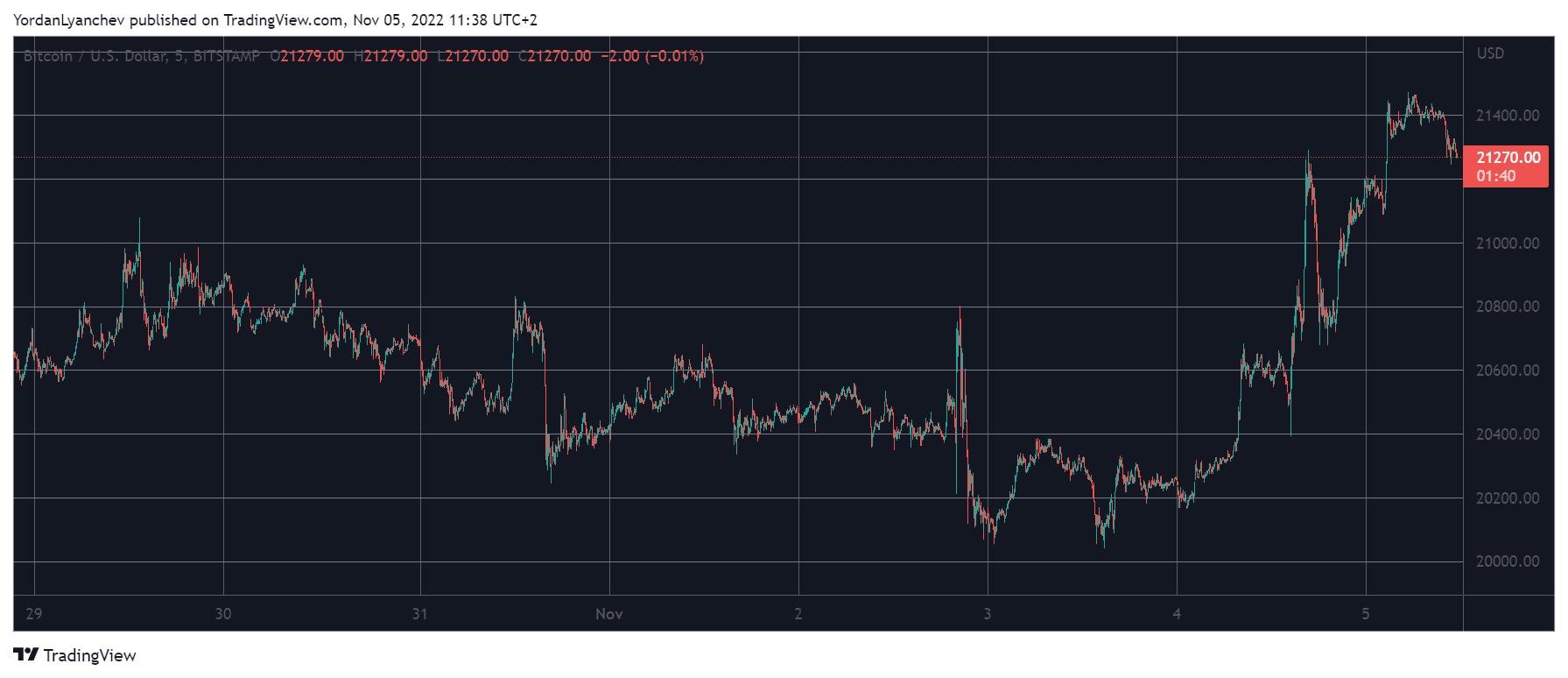

The primary cryptocurrency went through enhanced volatility at the start of the month, as CryptoPotato warned before, following events coming from the United States. At first, the Federal Reserve hiked the interest rate by 75 basis points, which sent BTC south from $20,800 to $20,000.

However, the bulls defended that level, and when the higher-than-expected US job report came out two days later, bitcoin started gaining value. As such, it came close to $21,000.

Although it failed at that level during the previous two attempts to overcome it, this time, the asset shot through it. As a result, it jumped to $21,500, which became the highest price tag BTC has seen in almost two months.

As of now, it has retraced by a few hundred dollars but still stands north of $21,000. Its market cap sits well above $400 billion, and its dominance over the altcoins is at 38.5%.

MATIC Soars Yet Again

Ethereum has added another 3.5% in the past 24 hours and trades well above $1,600. Binance Coin, Cardano, Polkadot, Shiba Inu, Tron, and Avalanche are also with some minor gains on a daily scale.

Dogecoin, Solana, and Polygon have surged by more than 5%. DOGE has been among the best performers in the past 10 days, ever since Elon Musk brought a sink into Twitter’s headquarters. The billionaire fired almost half of the social media platform’s staff yesterday.

Solana’s 8% surge has driven the asset to $35. MATIC, on the other hand, another notable gainer, trades at $1.2.

Most other lower- and mid-cap alts are in the green now as well. As such, the cumulative market cap has added $40 billion and is at a multi-month high of its own at $1.060 billion.

The post Bitcoin Closes Highest Daily Candle Since September 12th (Market Watch) appeared first on CryptoPotato.