Bitcoin Price Analysis: BTC Finally Breaking Up, But Now Facing Crucial Resistance

It finally happened: After four failed attempts during the first months of 2022, Bitcoin managed to overcome the critical resistance line at $46K and the hope returned to the market.

While the bears struggled to defend this area, the bulls were able to take control by liquidating more than $400 million of open positions. Most of the indicators are now in the bullish zone.

Technical Analysis by Grizzly

The Daily Chart

On the daily timeframe, the ROC 30d indicator was able to break above a descending trend line (marked by red) after more than a year and left market participants optimistic about the short-term future.

Breaking above the resistance at $46k and consolidating above it, as well as the formation of a higher-high, technically confirm the reversal of the recent downtrend.

However, the trading volume is still low (marked by blue), and it is the only concerning element. Under healthy market conditions, the trading volume increases as the price rises.

Looking forward, if the bulls can persist higher, the first major resistance lies at $52K.

On the other hand, daily support levels lie at $46k & $42.5K

Moving Average Exponential levels:

EMA20: $41.8K

EMA50: $41.2K

EMA100: $42K

EMA200: $48.2K

The 4-Hour Chart

On the 4-hour timeframe, Bitcoin has reached a short-term resistance at $48K (marked by red), which is in line with the EMA-200 on the daily timeframe.

The RSI-14 indicator also enters the overbought zone, which has been under a relatively deep correction twice when this happened before. It is better to be a little cautious before jumping into the market.

Short-term Support Levels: $46K & $44.7K

Short-term Resistance Levels: $48K & $49.5K

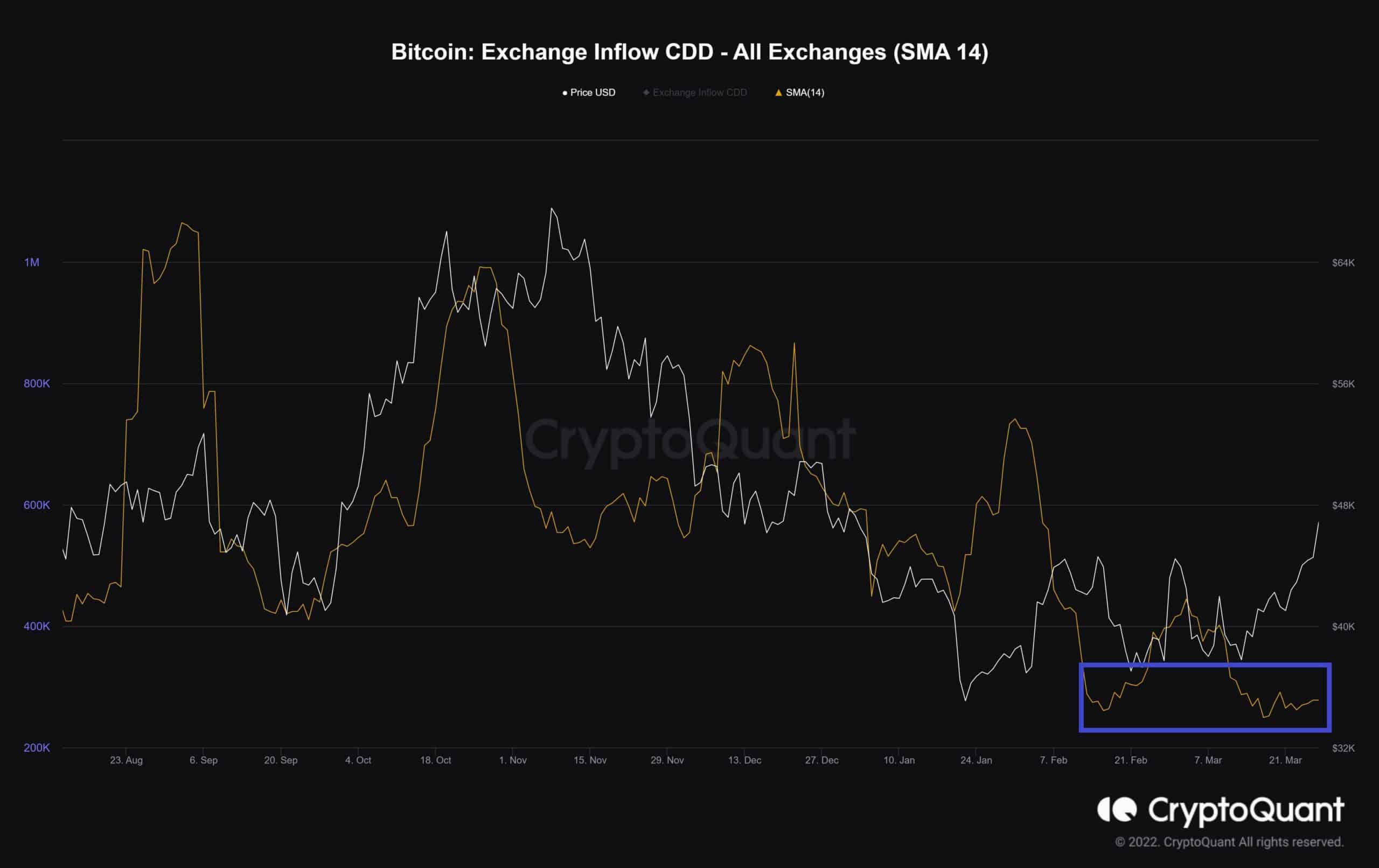

On-chain analysis: Exchange Inflow CDD (SMA14)

Coin Days Destroyed (CDD) of coins destroyed by flowing into exchanges.

High values indicate that more long-term holders moved their coins for the purpose of possible selling.

As we can see in the above chart, this metric has reached its lowest level after the all-time high, indicating that long-held coins are moving in fewer amounts, which reduces the selling pressure from long-term holders.

It is clear that when long-term holders moved their bags into exchanges, the selling pressure has increased drastically and we have witnessed a correction shortly after. This is demonstrated by the local tops on the chart.

Miners Position Index (MPI) (SMA 14)

Miners’ Position Index (MPI) is the ratio of total miner outflow (USD) to its one-year moving average of total miner outflow (USD). Higher value shows that miners are sending more coins than usual, indicating possible selling.

If the miners send some proportion of their reserves simultaneously, it could trigger a price drop.

Now, this is a sign that traders should be a little more careful and have a plan for every market movement in advance.