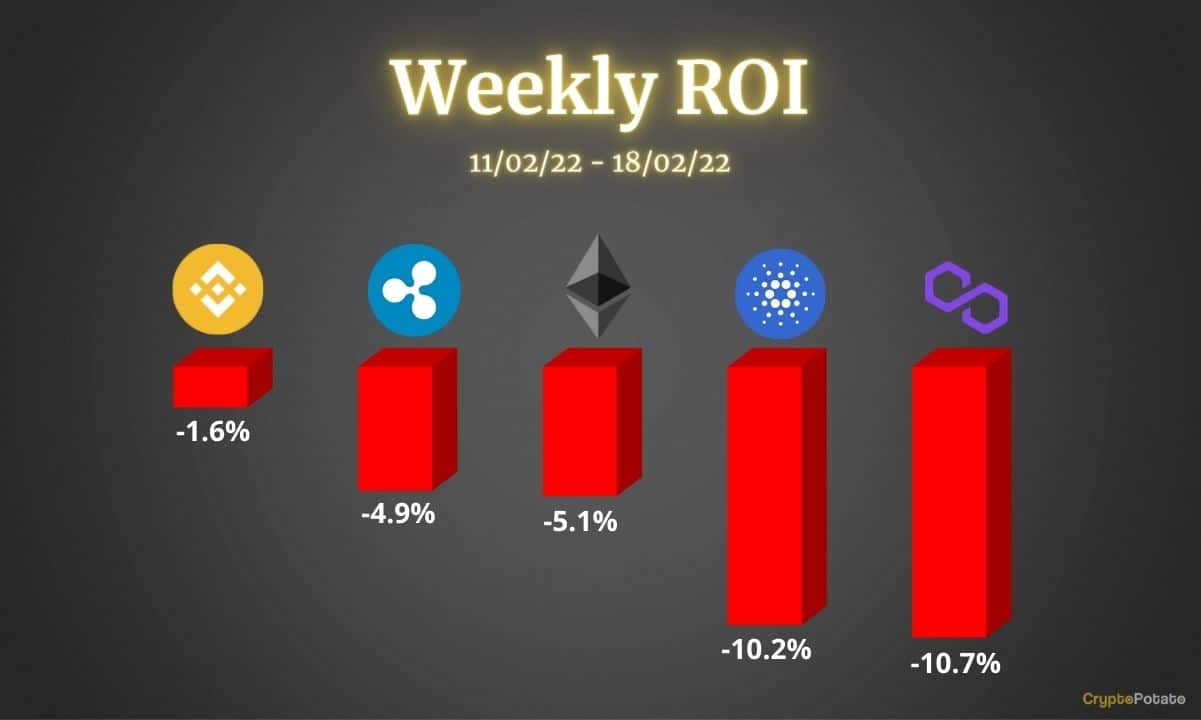

Crypto Price Analysis Feb-18: Ethereum, Ripple, Binance Coin, Cardano, and Polygon

This week, we take a closer look at Ethereum, Ripple, Binance Coin, Cardano, and Polygon.

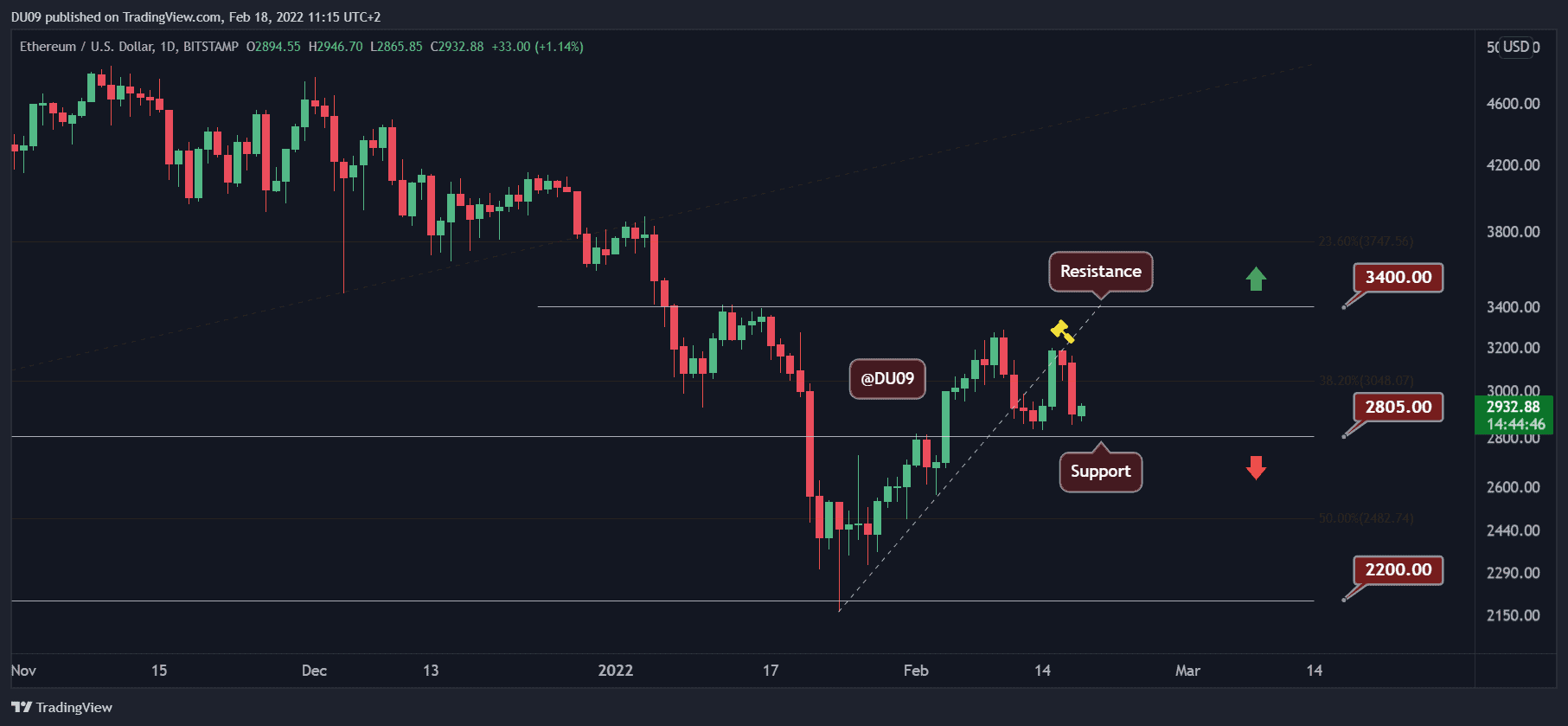

Ethereum (ETH)

The last two days were not easy for ETH as the price corrected back to the critical support at $2,800, falling almost 5% in the past seven days. Today’s price action shows that buyers came back once the cryptocurrency hit the support level, with price stabilizing just above it.

The worry now is if ETH correction will end here or continue. Should the key support level fail to hold in the coming days, then the overall market structure will turn bearish, and it will become more likely for ETH to approach the previous local low at $2,200.

The indicators on the daily timeframe are curving down and may turn bearish soon if buyers do not put ETH back on the uptrend. So far, the resistance at $3,200 has held it back from moving higher.

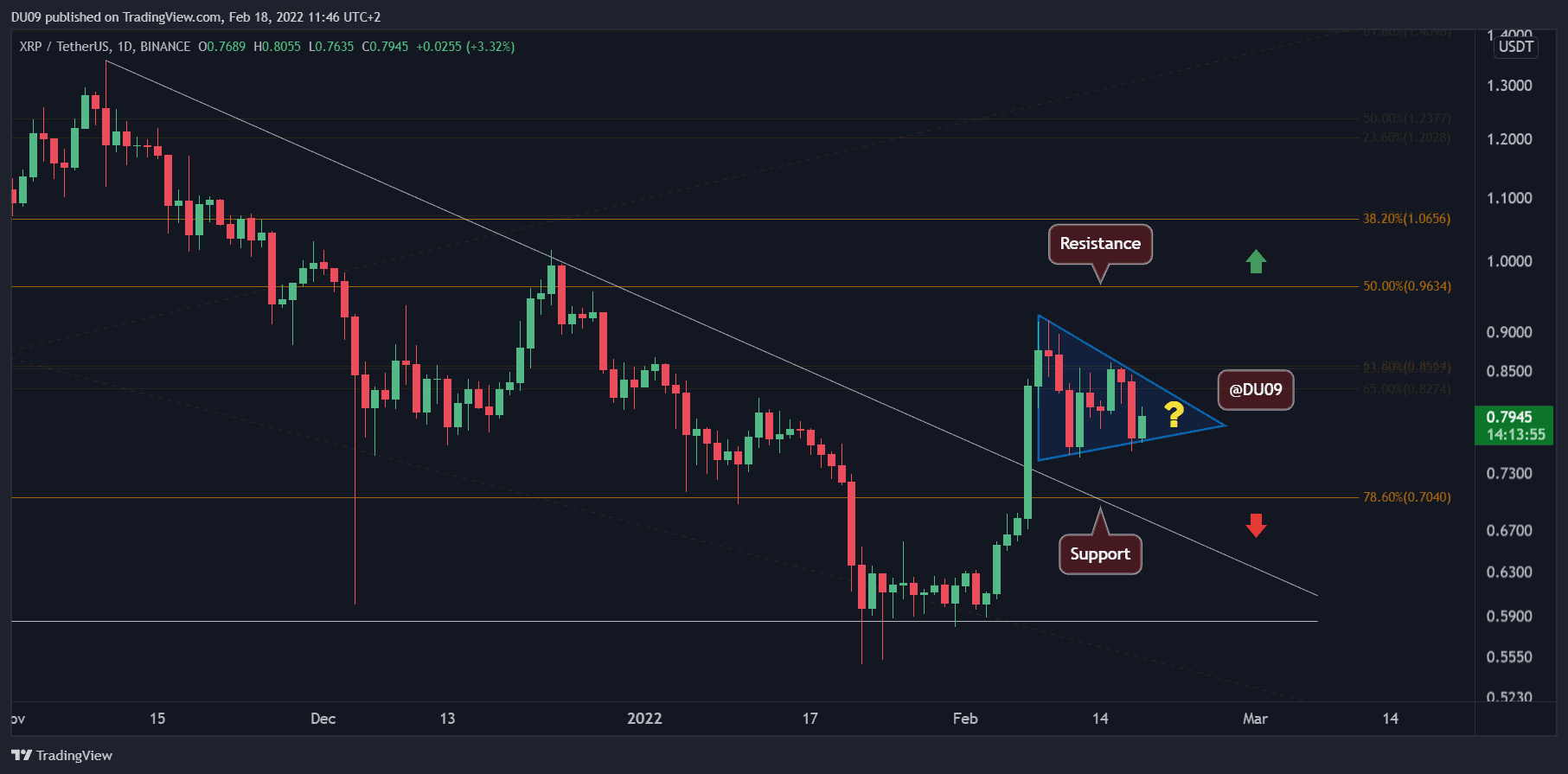

Ripple (XRP)

After a strong rally last week, XRP has entered into a consolidation, forming a large pennant. For this reason, volatility decreased, and the price closed the past seven days with a 4.9% loss. A break from the pennant will decide where XRP is headed next. The key resistance sits at $0.96 and the support at $0.70.

With decreased volatility, the volume also faded, but this is expected to spike once the price leaves the pennant. The current price action is in a flat trend, and the indicators are turning bearish similar to ETH.

Looking ahead, the cryptocurrency surprised the market with this most recent rally, and if it can eventually break above $1, then it will be back in the spotlight. It is crucial for the price not to fall under the key support for this scenario to play out.

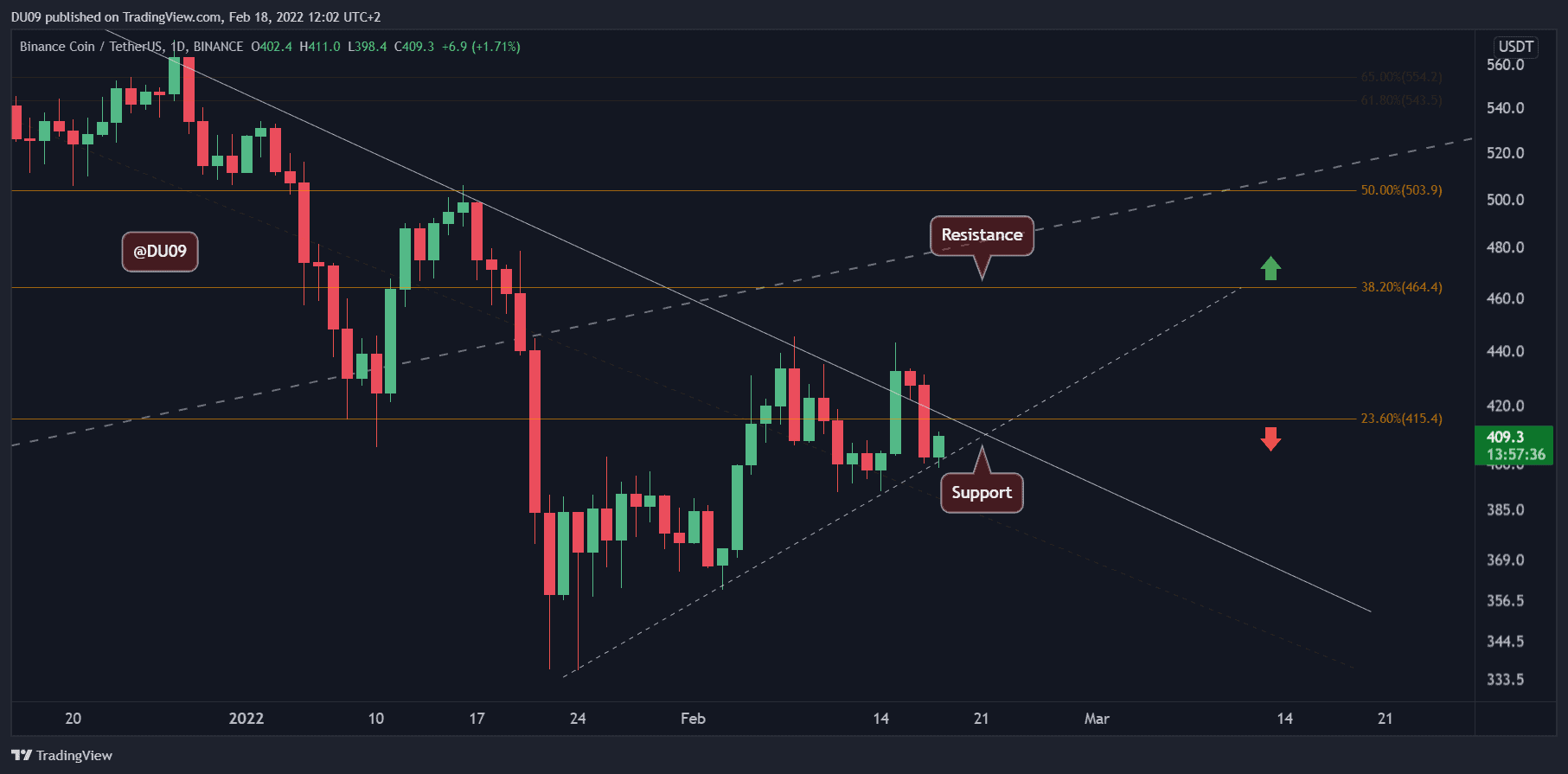

Binance Coin (BNB)

BNB brought a lot of excitement this week when the price broke above the downtrend that started in November 2021. Unfortunately, yesterday, the market turned bearish and pushed BNB’s price back below its breakout level. For this reason, the cryptocurrency returned to where it was seven days ago and registered a 1.6% loss at the time of this post.

If the price can move above $415 again, then BNB has a good chance to rally towards the key resistance at $465 and leave the downtrend once again. The current support at $400 has held well this most recent fall, and it is crucial to hold in the next few days as otherwise, BNB’s structure will turn bearish.

The indicators on BNB are rather flat on the daily timeframe, which shows that the market can go in either direction from this current level. Looking ahead, as long as BNB manages to stay above $400, it has a good chance to rally again.

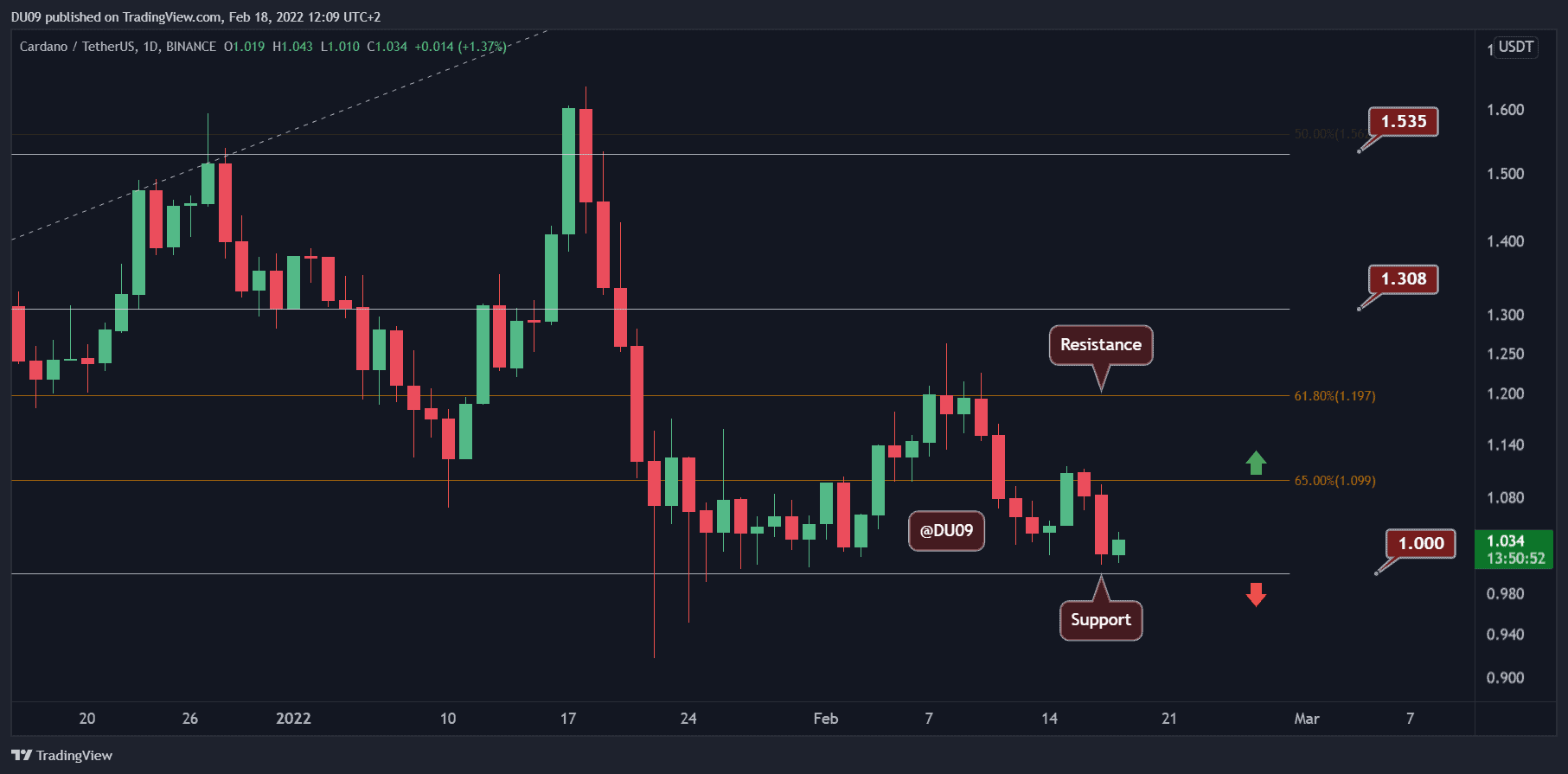

Cardano (ADA)

Unfortunately for ADA, the price remained in a downtrend for most of the past seven days, registering a 10% loss at the time of this post. The indicators remain bearish, and ADA is quickly approaching the key support at $1. Buyers need to defend this key level, otherwise, the prospects for ADA in the near future are grim.

The daily indicators are bearish, with the MACD doing a negative crossover yesterday and the RSI continuing to make lower lows. This is not encouraging, but ADA does have a chance to stay afloat if buyers manage to keep it above $1.

ADA also has two key resistance levels at $1.1 and $1.2, and in February these levels rejected any attempt from the price to move higher.

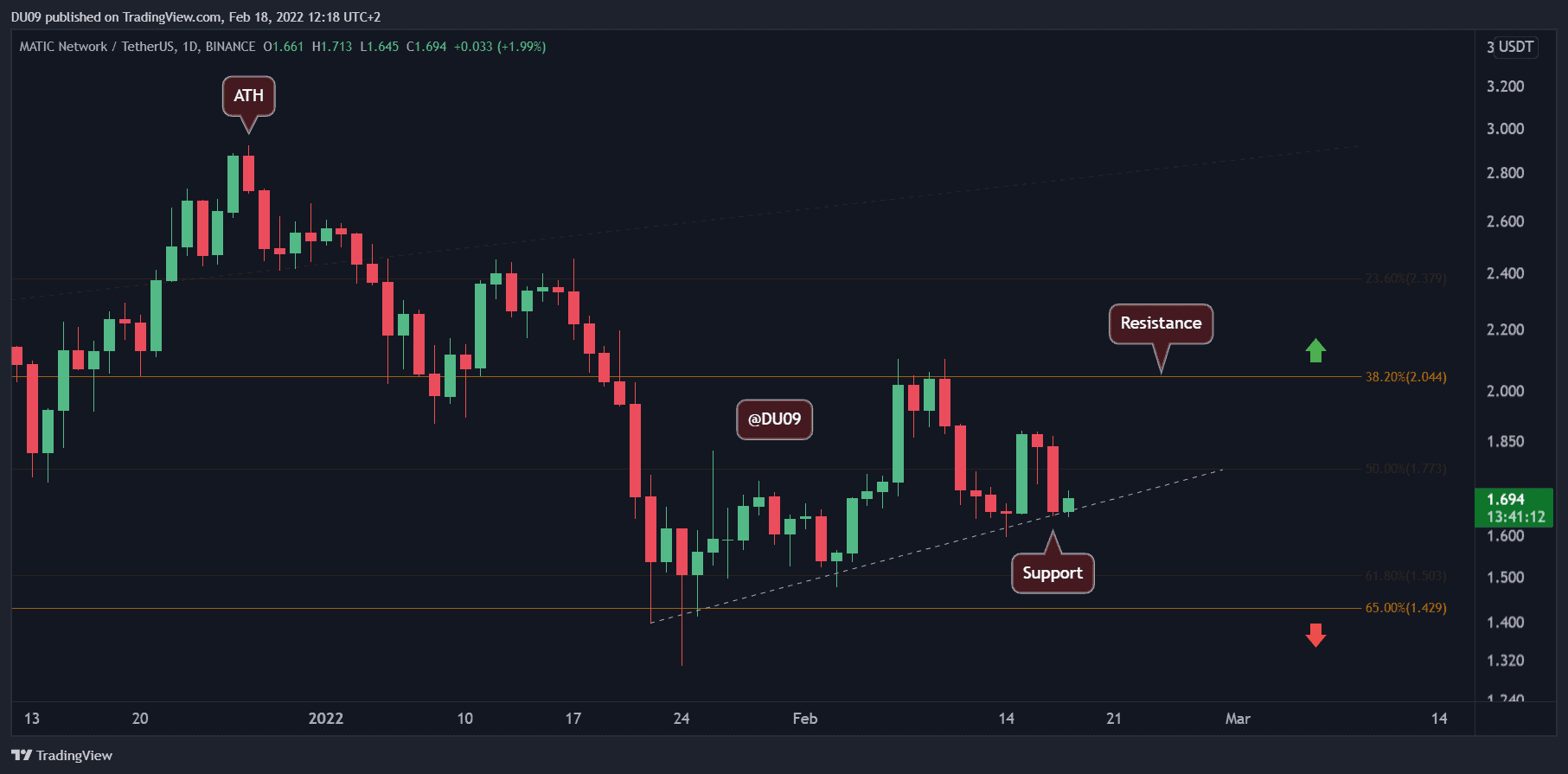

Polygon (MATIC)

Yesterday, MATIC has fallen to the key support at $1.7 and lost most of its gains from more than a week ago when the price was at $2. For this reason, the cryptocurrency closed the past seven days in red with a 10.7% decrease.

Despite the fundamentals and excitement around MATIC’s multi-chain system, the price action is still very much impacted by the broader market. BTC’s most recent correction pulled most altcoins down, including MATIC, which decreased more severely due to its recent rally.

While the indicators are bullish at the time of this post, the momentum is fading quickly, and a negative cross on the MACD appears imminent if the price loses the support at $1.7. If that happens, MATIC will likely fall to $1.4. The key resistance remains at $2, and it is unlikely it will be tested again soon considering current market conditions.