Crypto Markets Lost $130B in a Day as Bitcoin Dumped to a 2-Week Low (Market Watch)

After flirting with $44,000 for a few days, bitcoin was violently rejected and dropped to a two-week low of around $40,000. The altcoins have also turned red with substantial price losses from Ethereum, Terra, Shiba Inu, MATIC, and others.

Bitcoin Dumps to $40K

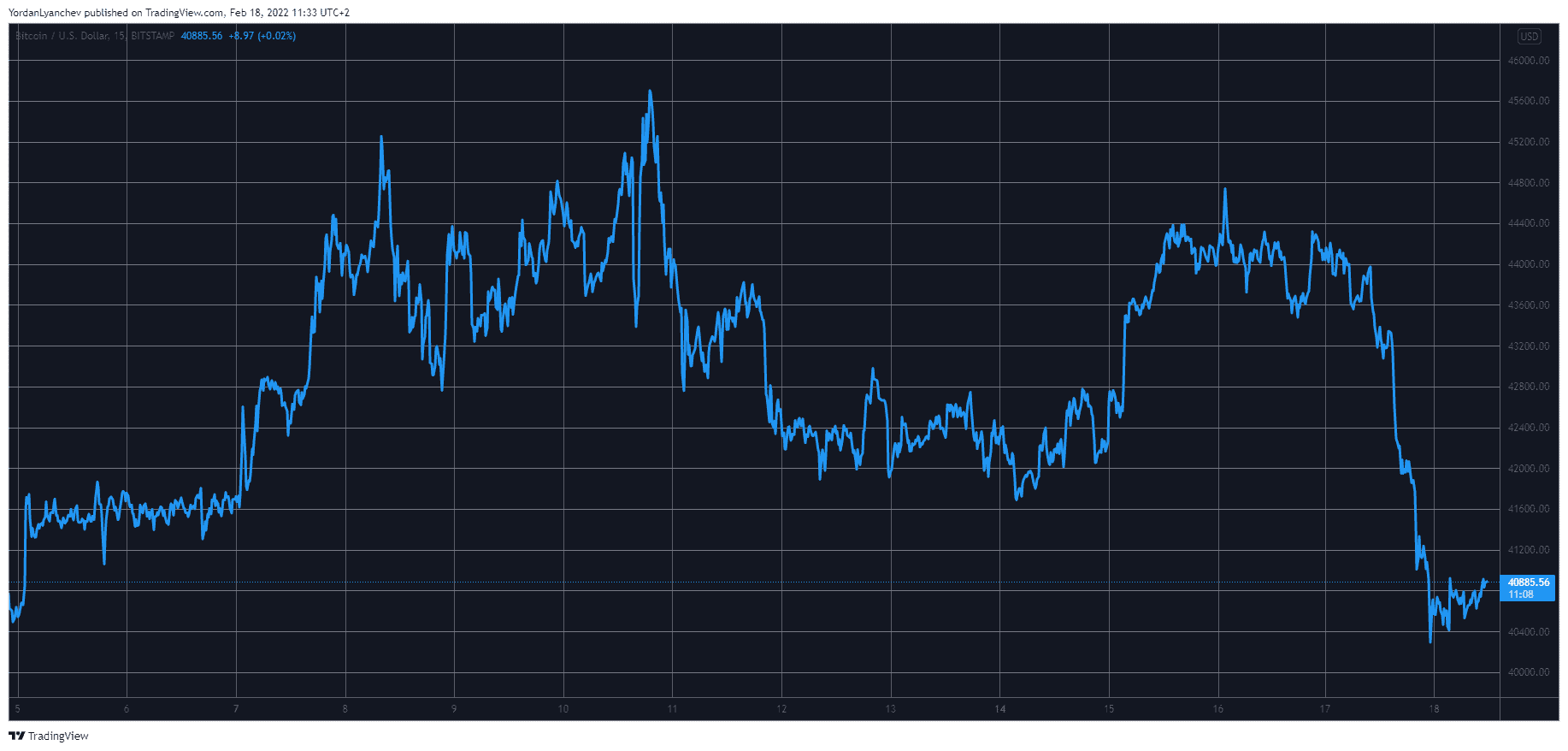

The past several days were actually quite positive for the primary cryptocurrency. After dipping to the 50-day moving average and January 2021 ATH of $42,000 on Monday and Tuesday, the asset went on the offensive and surged to nearly $45,000.

As it happened during the previous attempt to decisively overcome that level, though, BTC reversed its trajectory and started to nosedive.

In a matter of hours, BTC dropped by several thousand dollars and went all the way down to just over $40,000 (on Bitstamp). This became the cryptocurrency’s lowest price point since February 4th.

This enhanced volatility caused pain for over-leveraged traders as the liquidations skyrocketed to about $300 million on a daily scale.

As of now, BTC stands around $41,000, but its market capitalization has dumped well beneath $800 billion.

Altcoins Turn Red Too

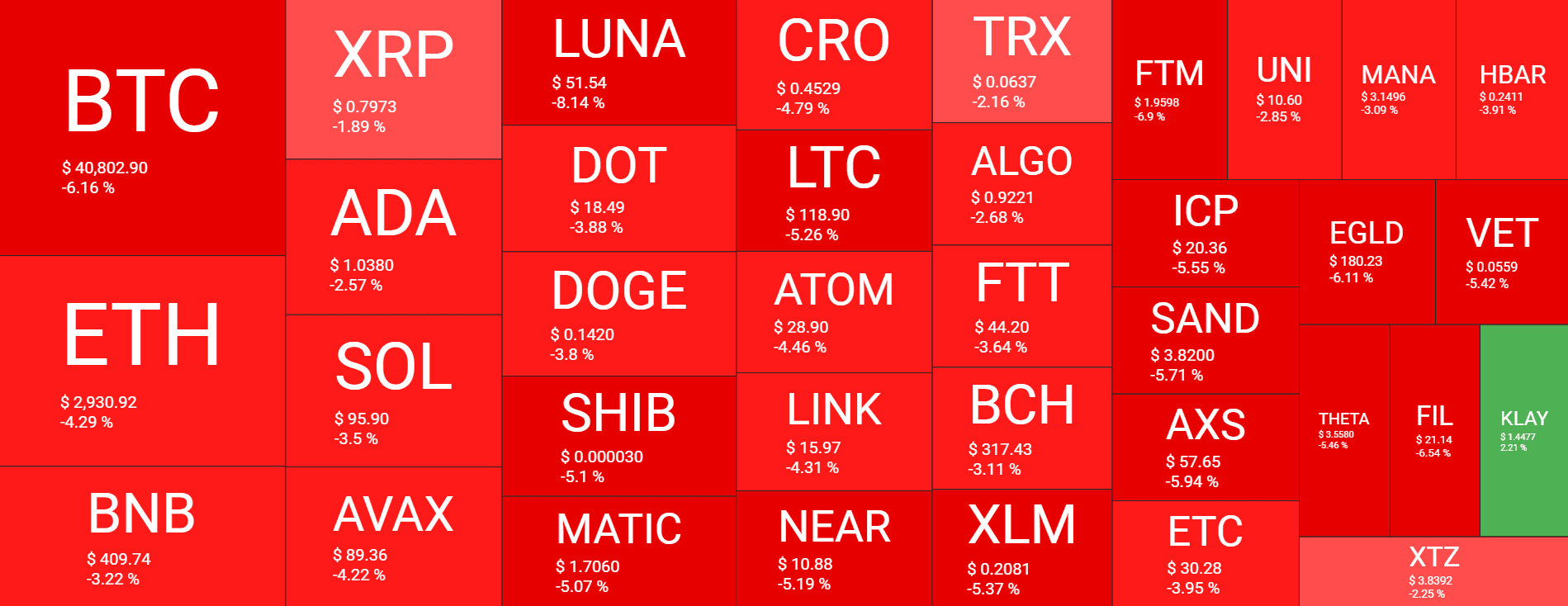

As it generally happens, the alternative coins are also deep in red in line with BTC’s price drops. Ethereum went above $3,200 just a few days ago but failed to continue upwards and headed south shortly after. The second-largest crypto struggled to remain above $3,000 yesterday and actually dumped beneath that level hours later. As of now, ETH stands at around $2,900.

Similar price declines are evident from Binance Coin, Ripple, Cardano, Solana, Avalanche, Polkadot, and Dogecoin. Terra (-8%), Shiba Inu (-5%), MATIC (-5%), CRO (-5%), and LTC (-5%) are even deeper in red.

More losses are evident from Aave (-8%), VeChain (-7%), Elrond (-7%), Monero (-6%), Fantom (-6%), Filecoin (-6%), and others.

The cumulative market cap of all crypto assets decreased by more than $130 billion in a day and is down to $1.850 trillion.