Bitcoin Tumbles Below $48K After $300M Liquidated in a Day: Market Watch

Bitcoin lost more than $4,000 in the past 48 hours after a dump below $48,000. The alternative coins are also in the red again, with Ethereum trading beneath $3,800 and Solana nosediving by more than 7%.

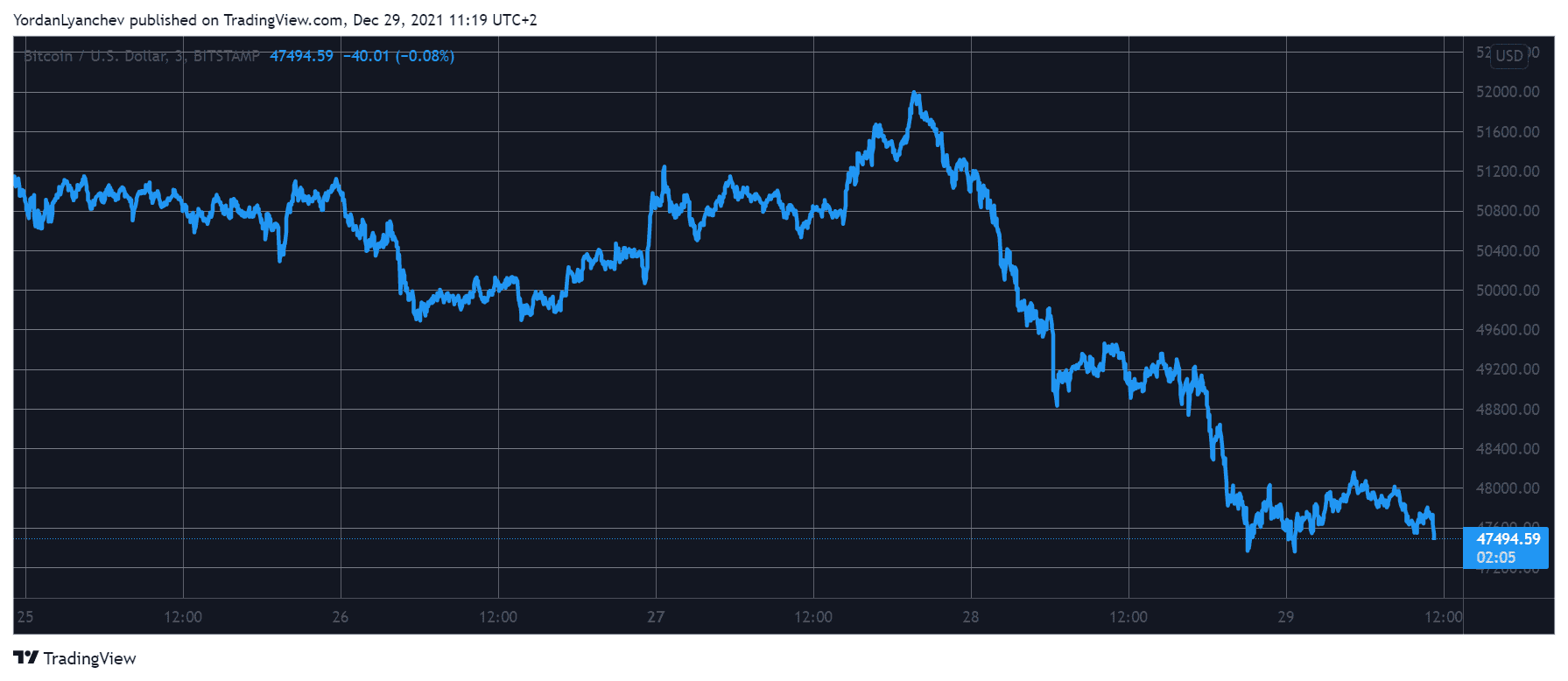

Bitcoin’s Two-Day Price Slide

It was just a couple of days ago when the landscape around the primary cryptocurrency seemed significantly more bullish. The asset had broken above $50,000 after several unsuccessful attempts and went on to chart a three-week high of $52,000.

This is where the situation changed vigorously as the bears stepped up. Instead of going further north, bitcoin started to lose value rapidly, resulting in a price slide to $49,000, as reported yesterday.

After this $3,000 daily drop, BTC only continued heading south. In the past 24 hours, BTC found itself dipping to $47,200, which is the lowest price point since December 21st.

As of now, the asset stands just over that level and is nearly 4% down on the day. Somewhat expectedly, this enhanced volatility has resulted in massive pain for over-leveraged traders as the liquidations exceeded $300 million since yesterday.

Alts in Red Again

The alternative coins suffered yesterday, and the situation today appears even more gloomy. Ethereum slipped below $4,000, but another 3.5% decline in a day has driven the second-largest digital asset to beneath $3,800. Binance Coin is down by 3% and stands at $535.

Solana has lost the most value on a daily scale (-8%). Consequently, SOL now trades at $175. More losses come from Cardano, Ripple, Terra, Polkadot, Avalanche, Dogecoin, and Shiba Inu from the larger-cap altcoins.

The lower- and mid-cap alts are in an even worse shape. ICON leads this adverse trend with a 16% decline to $1.53. Aave (-14%), Stacks (-10%), Cosmos (-10%), Kadena (-10%), Tezos (-8%), and many others, follow.

The cryptocurrency market capitalization is down by $200 billion in two days and is now at $2.240 trillion.