Bitcoin Dips to $10,400 as Crypto Market Loses $15 Billion on BitMEX News (Market Watch)

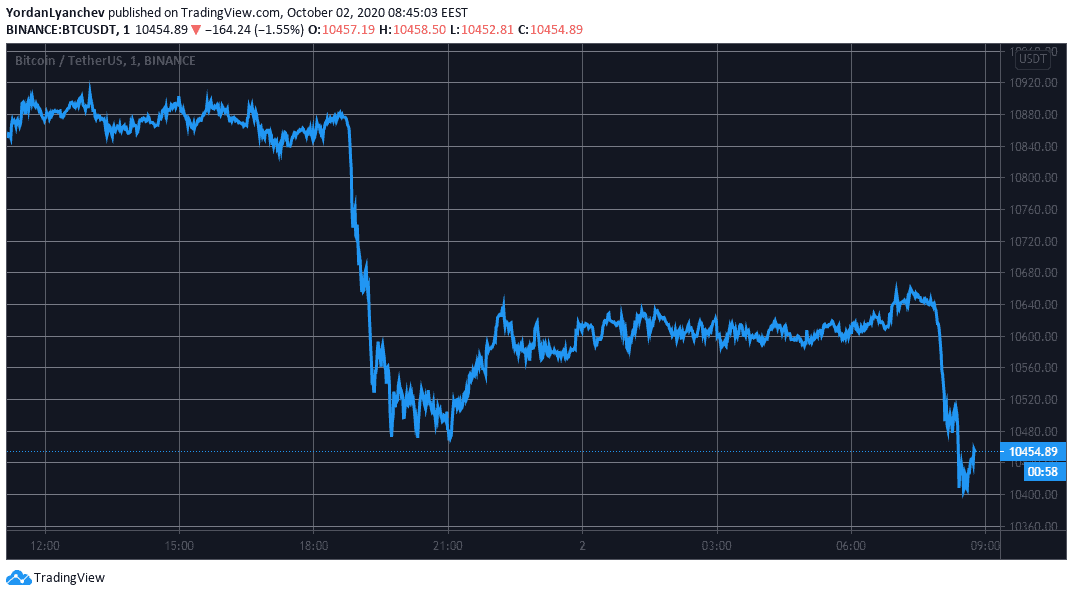

Bitcoin was riding high around $10,900 before dumping below $10,500 following the controversial BitMEX news from yesterday. Most alts have copied the move downwards, resulting in a $15 billion loss for the market cap.

Bitcoin Tumbles On BitMEX News

As CryptoPotato reported yesterday, the US Commodity and Futures Trading Commission charged the owners of one of the largest Bitcoin derivatives exchange, BitMEX, for illegally operating the platform and anti-money laundering violations.

Being such an important part of the cryptocurrency ecosystem, the BitMEX news immediately impacted prices within the industry.

Following a few positive days, Bitcoin was hovering around $10,900, but it vigorously dropped by about $450. In just minutes, the asset bottomed at $10,450 (on Binance).

BitMEX quickly issued an official response, claiming that the exchange has “always sought to comply with the applicable US laws.” Furthermore, BitMEX reassured that it will continue operating “entirely as normal” and that all funds are safe.

It seemed as the statement returned some confidence in the market as Bitcoin jumped back to $10,650. However, in the past few hours, the primary cryptocurrency has been losing even more value. At the time of this writing, BTC trades at $10,450 following a brief dip to $10,400.

Alts Mimic Bitcoin

As it typically happens in the cryptocurrency industry, when Bitcoin falls hard, so do alternative coins. This time was no different, and red dominates the entire market.

After exceeding $360 yesterday, Ethereum has tumbled by 4% and is down below $350. Ripple and Bitcoin Cash have lost 4% of value as well. XRP fights to stay above $0.23, while BCH is beneath $220.

The most substantial price drops from the top 10 come from Binance Coin (-7.5%), Polkadot (-6%), Chainlink (-7%), and BitcoinSV (-8%).

The situation among lower and mid-cap alts is even worse. Swipe leads this adverse trend with an 18% drop. Energy Web Token (-16%), Yearn.Finance (-15%), Arweave (-14%), Algorand (-13%), UMA (-13%), Decentraland (-12%), Synthetix Network Token (-12%), DFI.Money (-11%), and Enjin Coin (-10%) follow.

Overall, the total market cap has plummeted from $350 billion to $335 billion.

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

Cryptocurrency charts by TradingView.