2 Worrying Signs That Can Lead to BTC’s Quick Drop Towards $20K (Bitcoin Price Analysis)

The crypto industry is experiencing a prolonged ongoing bear market and is down more than 70% since recording its all-time high during the late months of 2021. However, the recent price action had seen Bitcoin bouncing over 35% since the current bottom recorded in mid-June.

Technical Analysis

Technical Analysis By Shayan

The Daily Chart

The primary cryptocurrency had formed a continuation correction bearish flag pattern after failing to break the $19K significant support level and had been consolidating inside.

However, the lower boundary supported the price, leading to another mini rally toward the upper trendline. BTC then successfully broke above the 50-day moving average (~$21.3K) and completed a pullback.

Looking ahead, the 100-day moving average (currently at $27K) and the flag’s upper boundary will likely be the next major resistance levels for Bitcoin’s price.

If the price succeeds in breaching the mentioned areas, another bullish leg is highly anticipated. In contrast, if the price fails to break the flag’s upper trendline, a steep bearish trend will be expected while it might be the last move down to complete the capitulation stage of the market cycle.

The 4-Hour Chart

Bitcoin formed a wedge pattern a few weeks ago, resulting in the fact that the $19K level has served as excellent support and initiated a new bullish rally resulting in the breakout of the wedge. Then, we saw a breakout to the upside, which carried the recent rally we saw. BTC now facing its prior swing high.

A clear double-top price action pattern (which is a bearish reversal pattern) can be identified in Bitcoin’s 4-hour timeframe chart if the current level of $24K won’t get broken. In addition, there is an evident bearish divergence between the RSI indicator and the price, increasing the odds against Bitcoin’s latest movements.

Considering the double top pattern and the divergence between the RSI indicator and the price, Bitcoin seems likely to retest support at lower levels, even below $20K. If the $19K critical support level fails to hold the price, Bitcoin’s next destination will be the $16K mark.

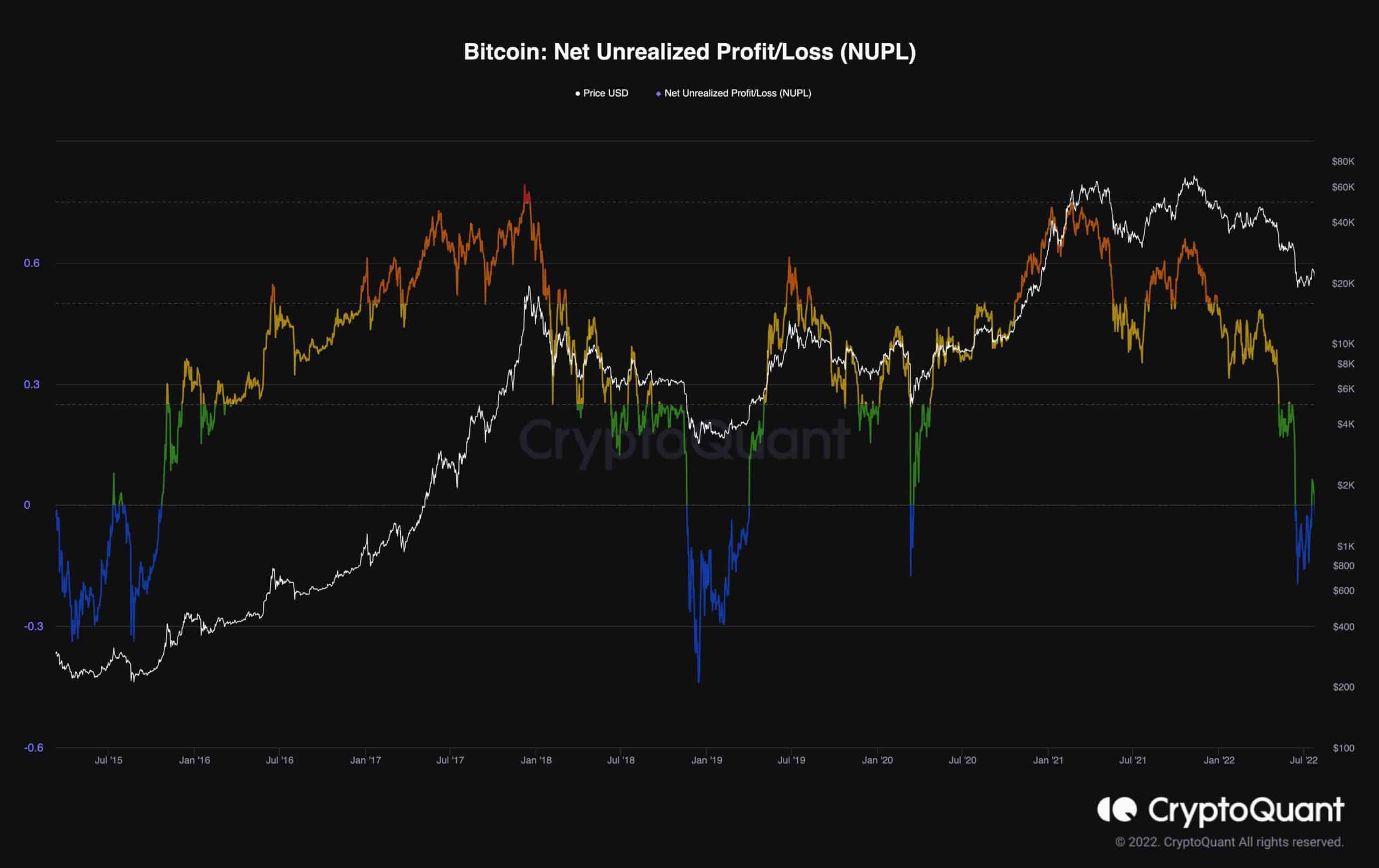

Onchain Analysis: NUPL

To identify current trends, it is helpful to examine the general sentiment of market participants. A bullish cycle frequently ends when key players reach the “distribution phase,” when they start selling their assets and realize profits.

Contrarily, a bearish cycle often concludes when big players enter the “accumulation phase” as they start buying coins sold by weak hands at discount prices.

Due to a sharp collapse in Bitcoin’s price below $20K for the first time since the Covid crash, the indicator has dropped to the blue region (= -0.09).

The market had previously seen considerable capitulation when this measure crossed into the blue area, which had led to a renewed bullish rally. However, following Bitcoin’s recent spike towards the $24K mark, the NUPL indicator has soared and entered the Green area.

The measure started a significant bullish cycle every time it crossed into the green zone after dipping into the blue site.