Bitcoin Touched $43K: Ripple Soars 12% to a 3-Week High (Market Watch)

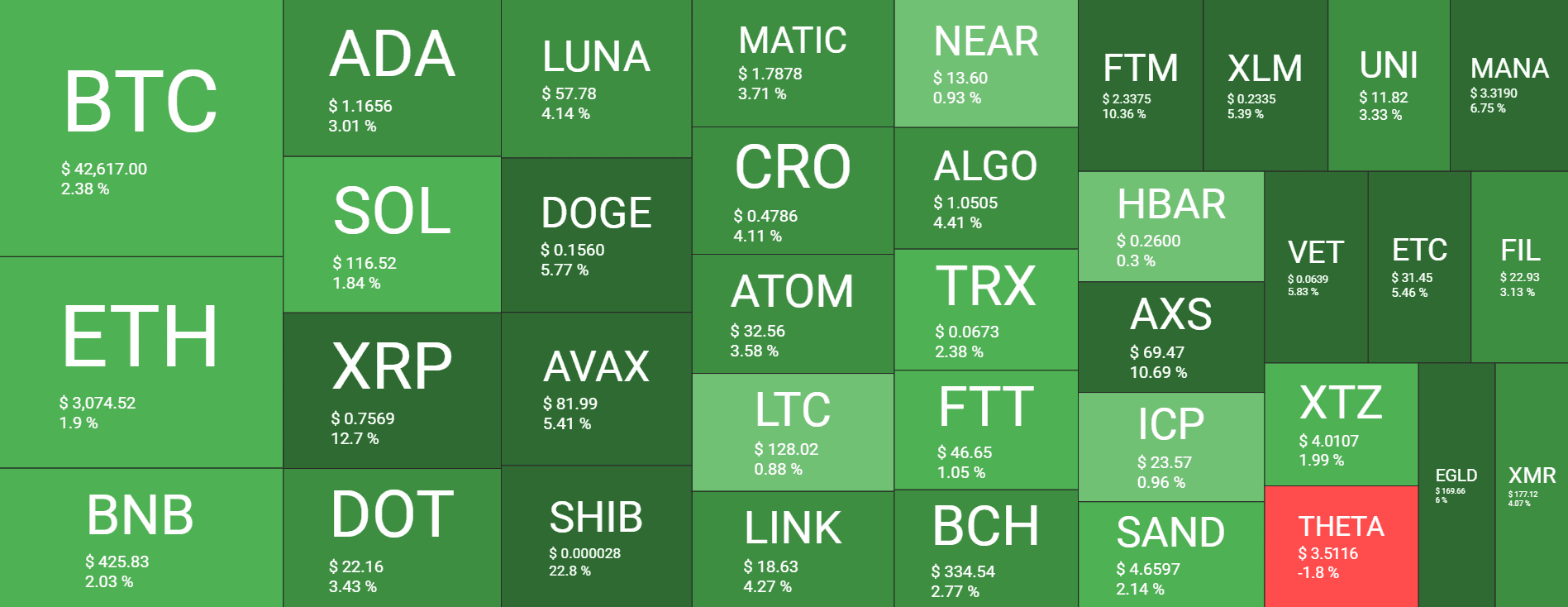

Bitcoin’s recent bullish run continued with another minor leg up that drove it to a high of $43,000. Most altcoins have produced similar slight increases; some, such as Shiba Inu and XRP, have exploded with massive double-digit pumps.

Bitcoin Touched $43K

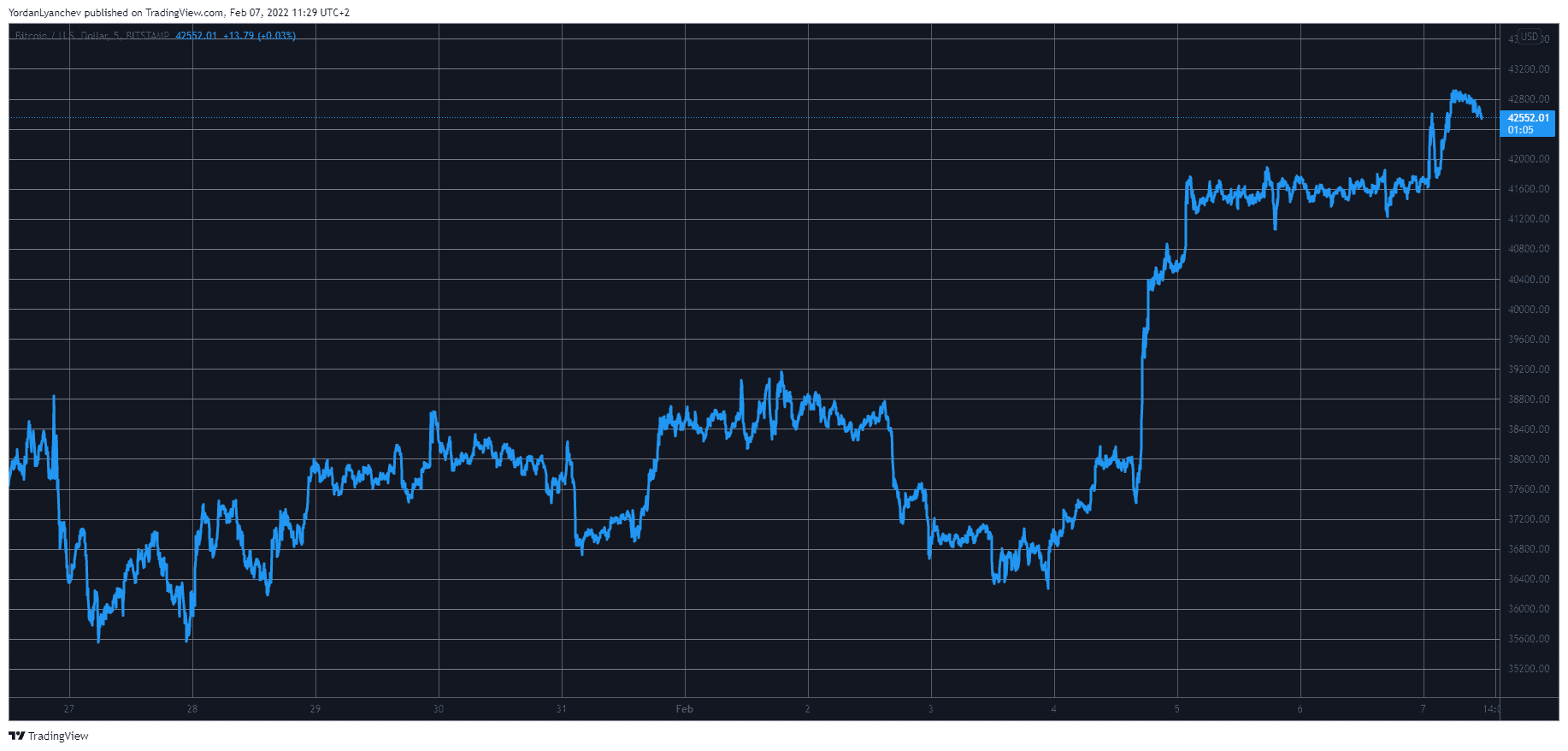

Ever since last Friday, when the cryptocurrency began its rapid ascent from $37,500, the BTC landscape has remained significantly more positive. Bitcoin surged to and beyond $40,000 in a matter of hours for the first time since mid-January.

The asset remained relatively calm, around $41,500 during the weekend before it initiated another price increase. This time, the bulls drove it to $43,000 for the first time since the market-wide correction started on January 21st.

As of now, BTC has been unable to reclaim that level decisively and has retraced by a few hundred dollars. Nevertheless, its market capitalization has surged above $800 billion. Just last week, the metric was down below $700 billion.

SHIB and XRP Steal the Show

Most alternative coins followed BTC on the way up with impressive gains in the past several days. Ethereum, for example, struggled to remain above $2,000 just a week or so ago. Now, though, the second-largest cryptocurrency stands well above $3,000 and even challenged $3,100 a few hours ago.

Binance Coin, Cardano, Solana, Polkadot, and Terra have marked similar gains in the past 24 hours of between 2% and 4%. More impressive increases come from Dogecoin and Avalanche.

However, Ripple and Shiba Inu have taken the main stage from the larger-cap alts. SHIB has exploded by more than 20% in a day, as reported earlier, and stands near $0.00003.

XRP, on the other hand, is up by approximately 13%. As a result, the asset tapped a three-week high at over $0.75.

More gains come from Quant (17%), BitTorrent (16%), LEO (14%), Kadena (13%), Loopring (12%), Gala (10%), and Fantom (10%).

The crypto market cap has increased by about $60 billion since yesterday and stands at $1.950 trillion.