Crypto Price Analysis Jan-28: Ethereum, Ripple, Cardano, Solana, and Luna

This week, we take a closer look at Ethereum, Ripple, Cardano, Solana, and Luna,

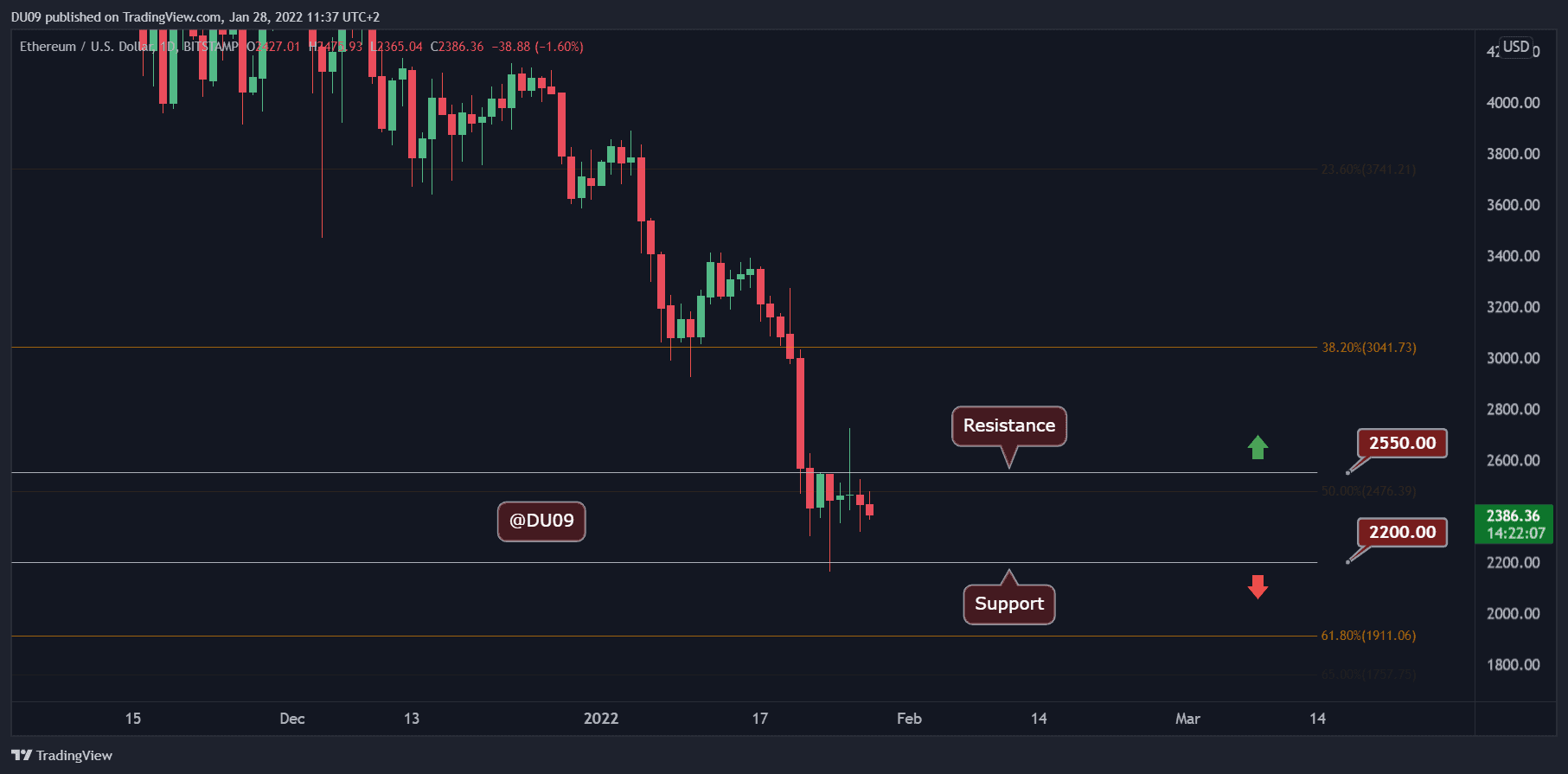

Ethereum (ETH)

This past week, ETH finally found support after a significant crash under the $3,000 level. The support at $2,200 managed to stop the downtrend, and now the price is found in a consolidation mode below the key resistance at $2,550. It was not an easy week for ETH, losing 20% of its dollar value.

The cryptocurrency attempted to rally this past Wednesday, briefly reaching $2,725 before sellers pushed the price back below the key resistance. Since then, ETH has not managed to retest the level and has moved sideways. While this shows some indecision in the price action, at least this most recent move has prevented ETH from dropping lower.

As price consolidates, market participants become more uneasy because there is no way to know if this consolidation precedes a further correction or a recovery. The indicators do not bring any confidence on the buyer side, and the overall market appears weak.

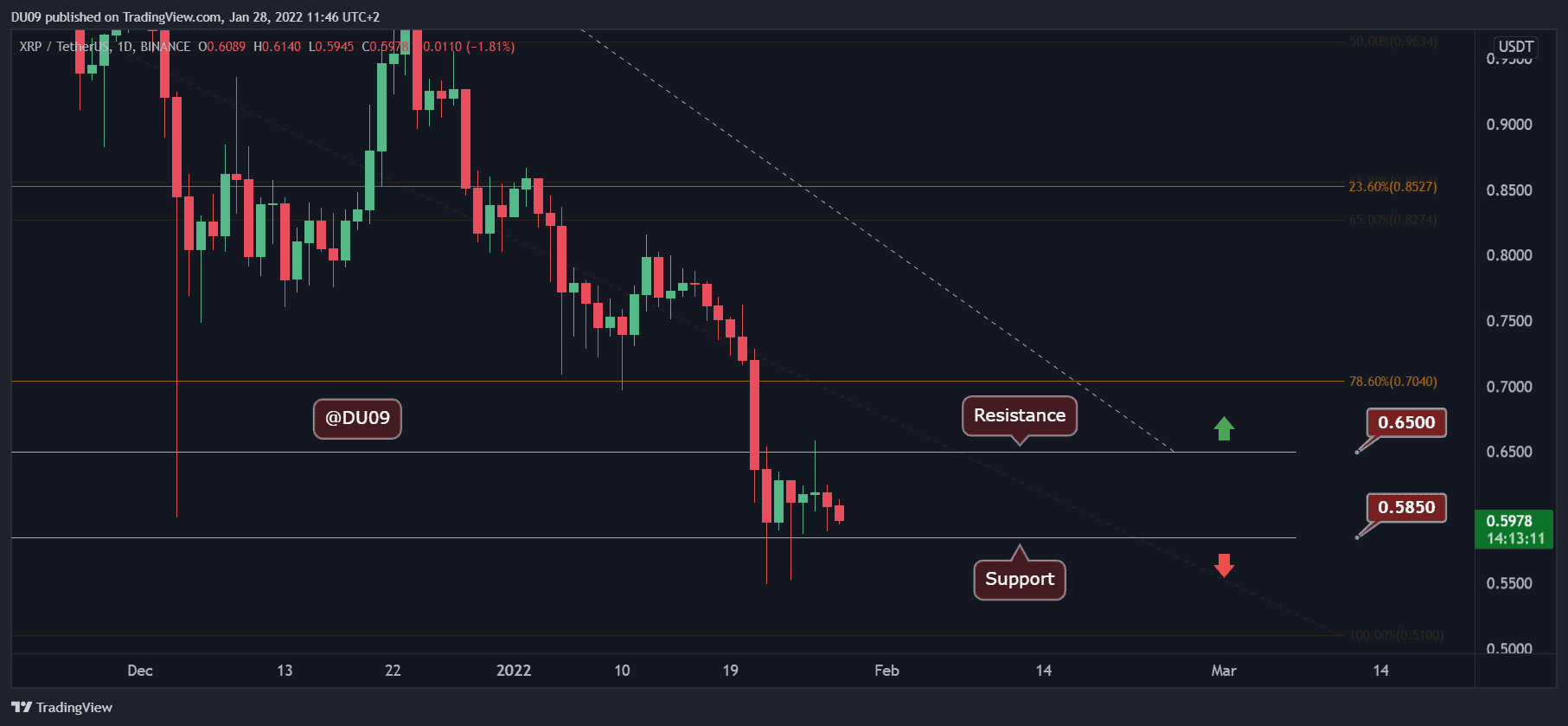

Ripple (XRP)

XRP has been moving just above the key support level at $0.58 for most days in the past week after a significant drop last Friday. Overall, XRP fell by 17% compared to seven days ago and has failed to recover most of the recent losses.

The current price action does not inspire confidence, and a retest of the key support appears likely. The resistance is found at $0.65, and the last retest was sharply rejected by the bears. Since then, the price has been on a slow descent towards support.

Looking ahead, XRP lacks buying pressure to attempt a breakout, and if the market remains weak, it may be that sellers will take advantage and push the cryptocurrency lower yet again. The RSI on the daily timeframe has not left the oversold area in over a week now. This signals a strong downtrend as the bias remains bearish for XRP.

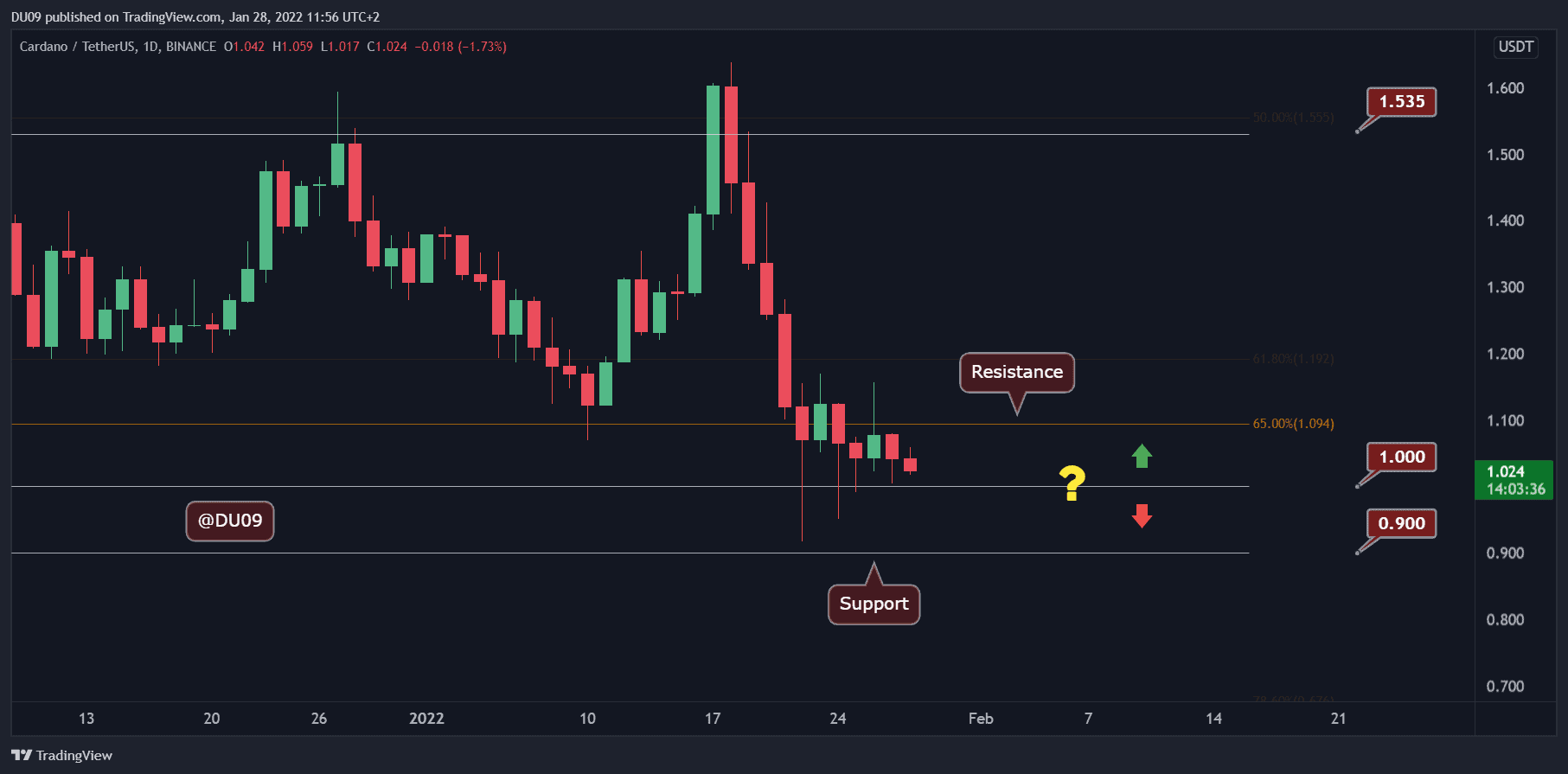

Cardano (ADA)

ADA appears on a clear path towards testing the support at $1 after failing to rally beyond the resistance at $1.1. Price has continued to make lower highs, and in the past seven days, ADA lost 19% of its dollar value.

Moreover, ever since the cryptocurrency made its all-time high at $3.1, the trend has been bearish, with lower lows and lower highs. The most recent lower low was made last Saturday. This re-confirms the bearish trend, and continuation is the most likely outcome. Volume has also decreased substantially, which may explain why the price is hesitating on where to go next.

A break below $1 might have a major psychological impact on ADA’s future price action. Therefore, it’s expected to see a significant battle over the coming days as buyers and sellers will fight for dominance around this key level.

Solana (SOL)

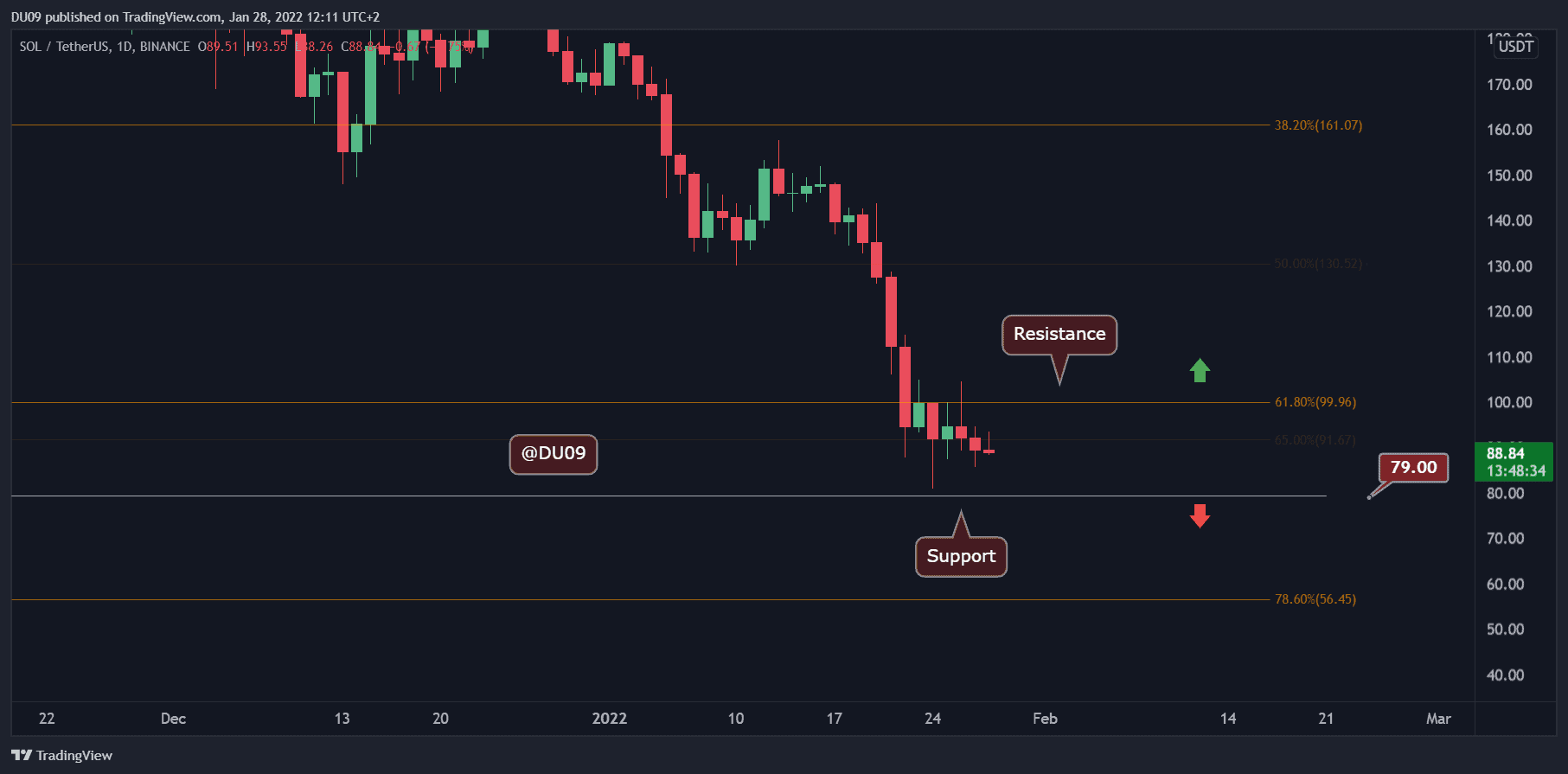

SOL mirrors ADA and shows a similar level of uncertainty just above the key support at $79. The price action remains bearish with lower highs and lower lows after a failure to break above the key resistance at $100. A retest of the support appears likely, and SOL closed the past seven days in red, losing 30% of its value.

Sellers continue to dominate the price action, with five red daily candles in the past seven days. Moreover, the daily RSI has been moving flat in the oversold area at around 24 points for over a week. The failure of SOL to rally and move away from such extremes is a warning sign that sellers may not have finished their job yet.

Looking ahead, SOL has a good chance to stop the downtrend at the $79 support level. Then, if buyers return to the market, it can attempt a recovery.

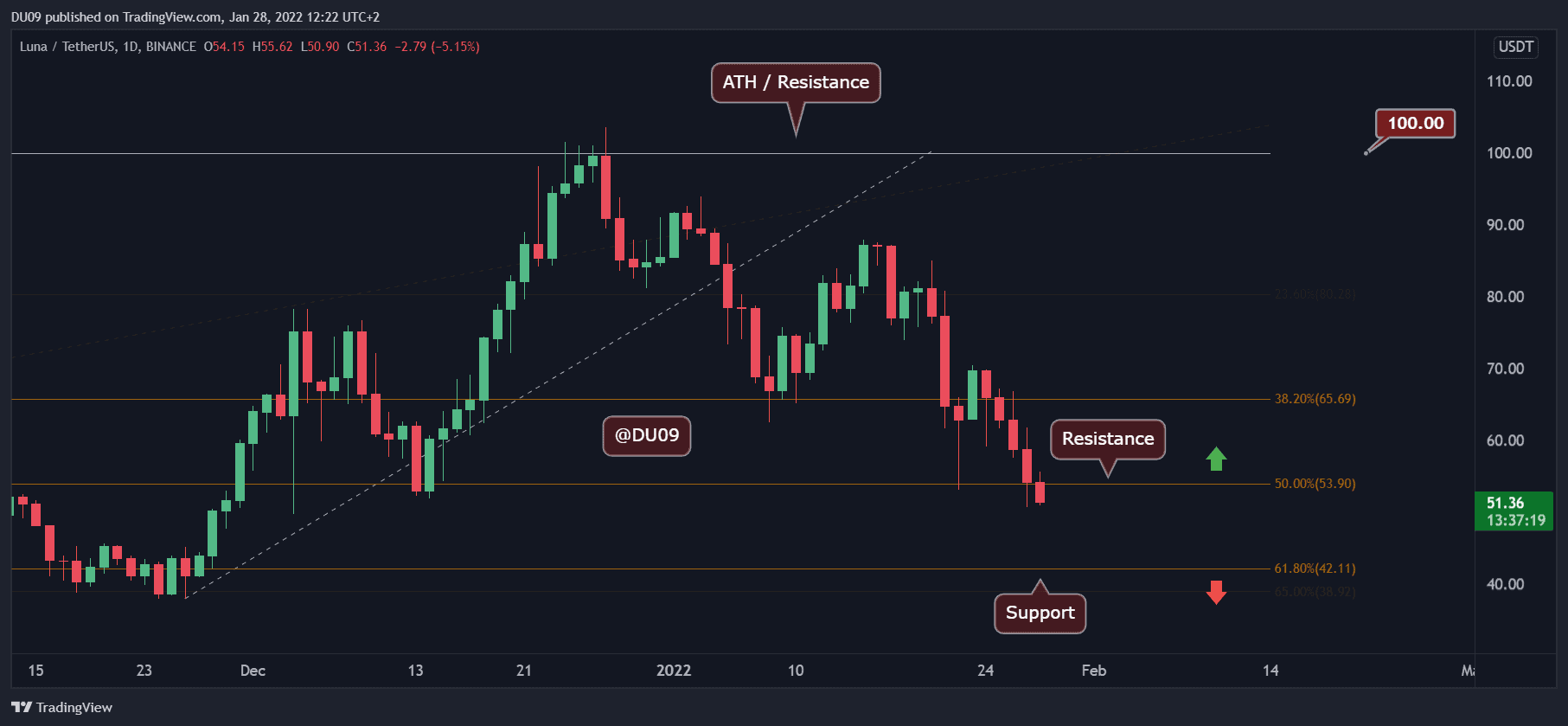

Luna

Luna lost a key support level yesterday, falling under $54, and now the price appears ready to move lower. If buyers cannot stop this selloff, then Luna is likely to fall to the next support level at $42. Overall, it had a very disappointing week, losing 33% of its value over the past seven days.

The former support level at $54 has now turned into resistance, and the indicators are in a free fall. The daily RSI has not yet reached the oversold area, indicating that Luna can continue to fall for quite some time until it reaches this extreme that may attract buyers again.

The MACD histogram and moving averages are also expanding downward, with little evidence this selloff will end soon. Right now, the sellers dominate the chart with six red candles in the past seven days.