Bitcoin Volatility Continues: LUNA Dips 13% (Market Watch)

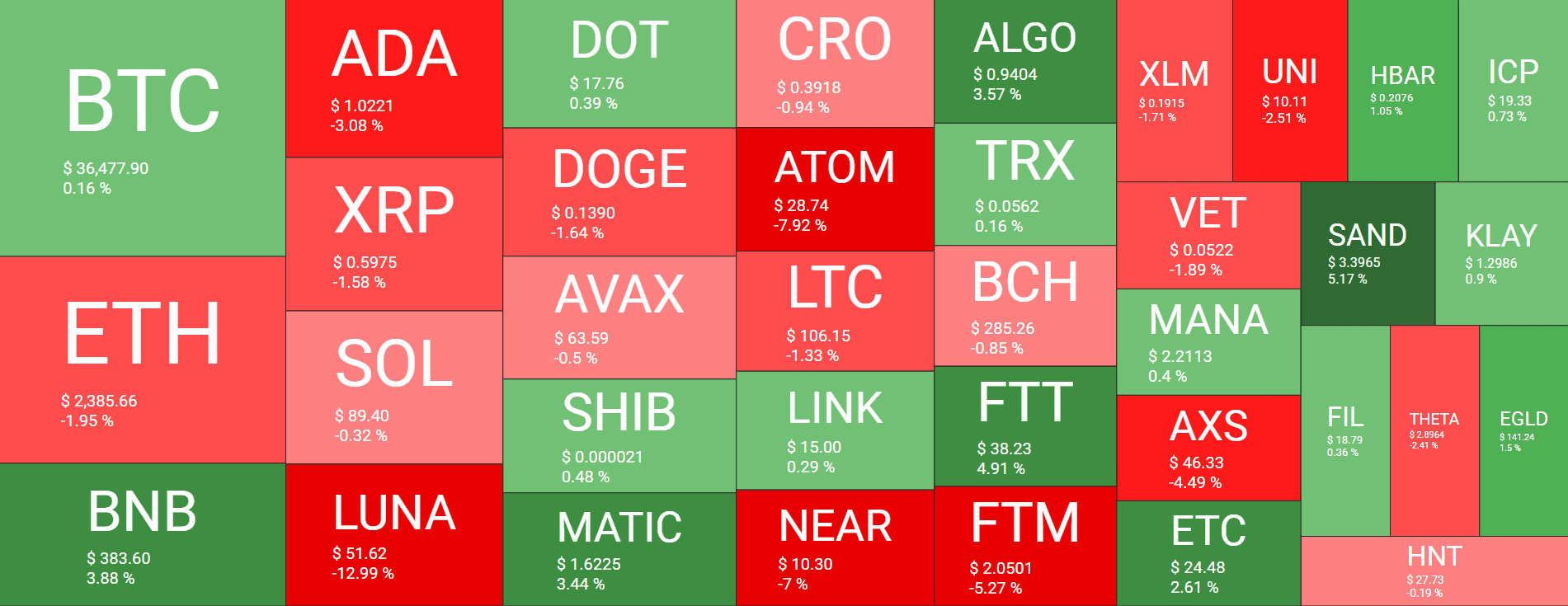

Following another sub $36,000 dip, bitcoin bounced off and tapped $37,500 before it was rejected. Most altcoins are somewhat calm on a daily scale, except for a few notable price drops from Terra, ATOM, and NEAR Protocol.

Bitcoin Calm at $37K

Bitcoin’s price has been on a roller-coaster in the past week or so, ever since it started to dump from above $43,000. This culminated in a drop below $33,000 days ago, which became its lowest price tag since late July 2021.

At that point, though, the asset reacted well and started to reclaim some of its lost ground. This resulted in a rapid price surge to $37,000 before the bulls initiated another leg up, in which the cryptocurrency touched $39,000.

After the Fed’s meeting in regards to its interest rates, though, BTC dumped once again by several thousand dollars to around $35,500. Another similar price decrease transpired in the past 24 hours before bitcoin shot up to $37,500.

The bears halted this leg up and pushed the asset down to its current position at around $36,500. As such, its market capitalization is still below $700 billion.

LUNA Dumps Double-Digits

Most alternative coins are untypically stable today with minor losses. Ethereum failed at overcoming $2,500, and the subsequent rejection drove it down to just under $2,400.

Cardano, Ripple, Solana, Dogecoin, and Avalanche are with similar daily price drops. In contrast, Binance Coin is up by 4% and stands above $380. Dogecoin, Shiba Inu, and MATIC have also seen minor gains.

Terra, however, is the most significant loser since yesterday. LUNA has dumped by 13% and is close to dropping below $50. More losses come from Convex Finance (-17%), NEAR Protocol (-9%), Gala (-9%), Cosmos (-8%), and Loopring (-8%).

The crypto market cap has declined by around $30 billion since yesterday, meaning that it has remained well below $1.7 trillion.