$300B Gone From Crypto Markets in 3 Days: Bitcoin Dipped Below $41K (Weekend Watch)

Bitcoin’s situation worsened once more hours ago as the asset dropped to a new three-month low beneath $41,000. Most altcoins are in a similar position today, and the overall losses from the past three days grew to $300 billion.

Bitcoin’s Latest 3-Month Low

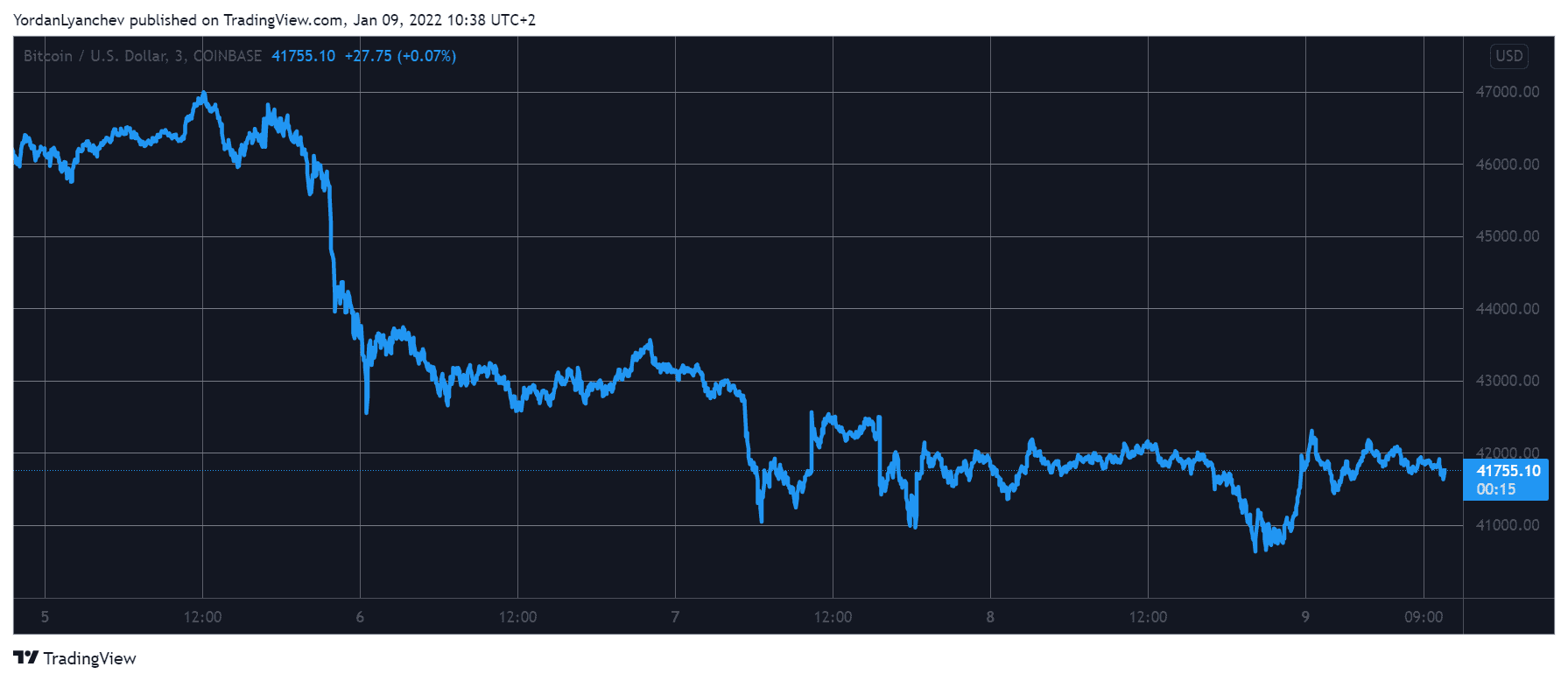

It’s safe to say that the primary cryptocurrency has seen better days. In fact, they weren’t all that long ago as it traded at $47,000 on Thursday and even tried its hand at $48,000 on Wednesday.

However, the bears took complete control in the following 72 hours. Firstly, they dumped BTC by $4,000 before another drop drove the asset below $42,000 on Friday, as reported.

Yesterday seemed like a consolidation day as bitcoin stood around $42,000 for a while. However, this didn’t last long as BTC dived once more. This time, it fell to $40,500, which became the lowest price line since late September 2021.

As of now, the cryptocurrency has recovered some ground and stands approximately $1,000 higher. Nevertheless, its market capitalization is still below $800 billion.

Altcoins Keep Dumping

The alternative coins have suffered just as badly as BTC, if not worse. Ethereum stood above $3,800 days ago, but now it’s just over $3,100 after another 3% decline since yesterday.

Binance Coin is down by 5.5% and struggles at $430. Solana (-4%), Cardano (-6%), Ripple (-3.5%), Polkadot (-5.5%), Terra (-1%), Avalanche (-5.5%), Dogecoin (-4%), Shiba Inu (-5%), and MATIC (-6%) are also deep in red.

Chainlink, yesterday’s best performer, is the only larger-cap alt that has endured this market correction without substantial losses.

In contrast, further losses come from Fantom (-12%), Oasis Network (-11%), Helium (-11%), NEAR Protocol (-11%), Zcash (-10%), Ravencoin (-10%), Gala (-10%), Loopring (-10%), and many others.

The cumulative market cap of all cryptocurrency assets is down to $1.950 trillion. This means that the metric has lost roughly $300 billion since the correction started three days ago.