Bitcoin Price Analysis: BTC Facing Friday’s Options Expiration, Marks Next Major Resistance

Option Market Analysis

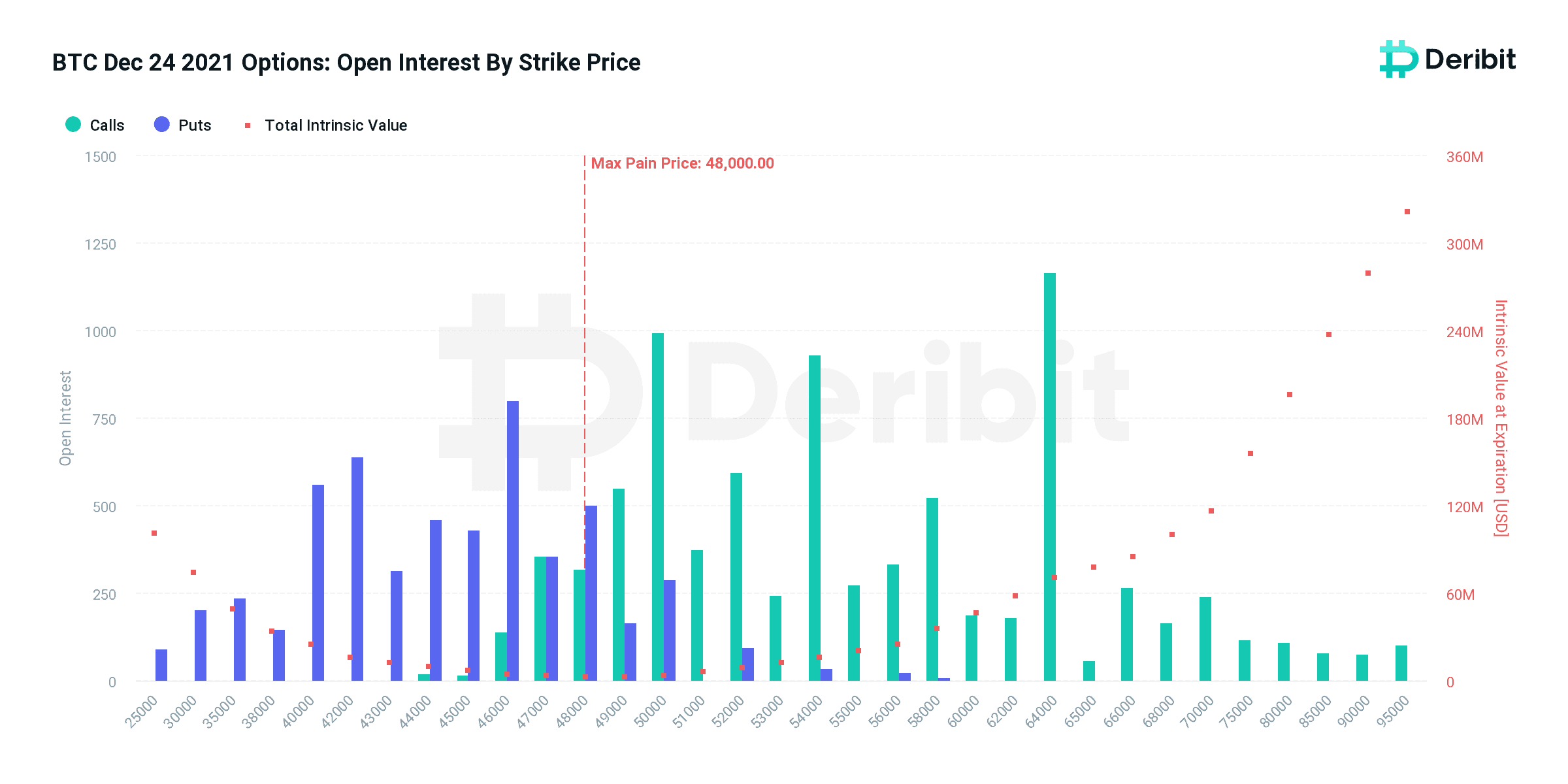

This Friday, 24 of December 21, about $684 million worth of Bitcoin options contracts will expire in Deribit Exchange. The maximum pain price – the strike price that brings maximum loss to option buyers – is $48k. The put/call ratio (PCR) is 0.67. Calls for a $64k strike price have the highest open interest.

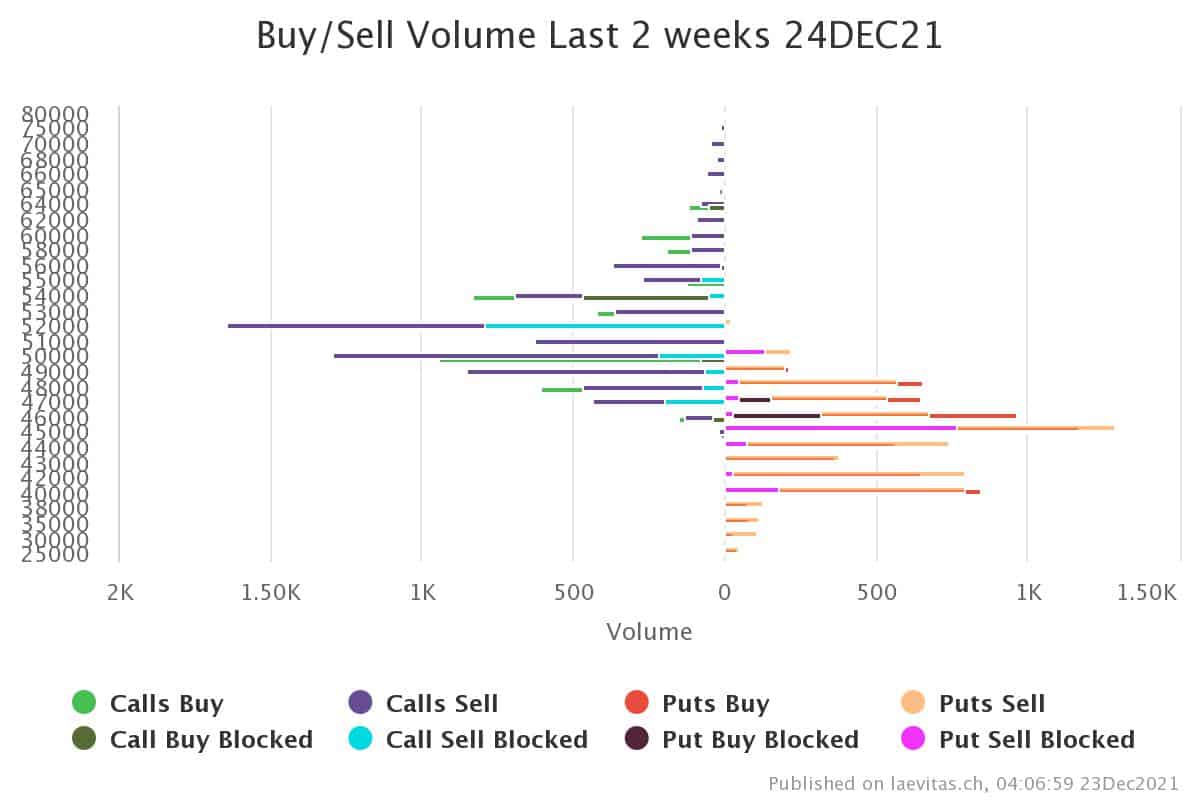

The last two weeks’ Buy/Sell volume shows that the call seller for the $52k strike still looks at this strike as a resistance for this expiry.

Technical Analysis

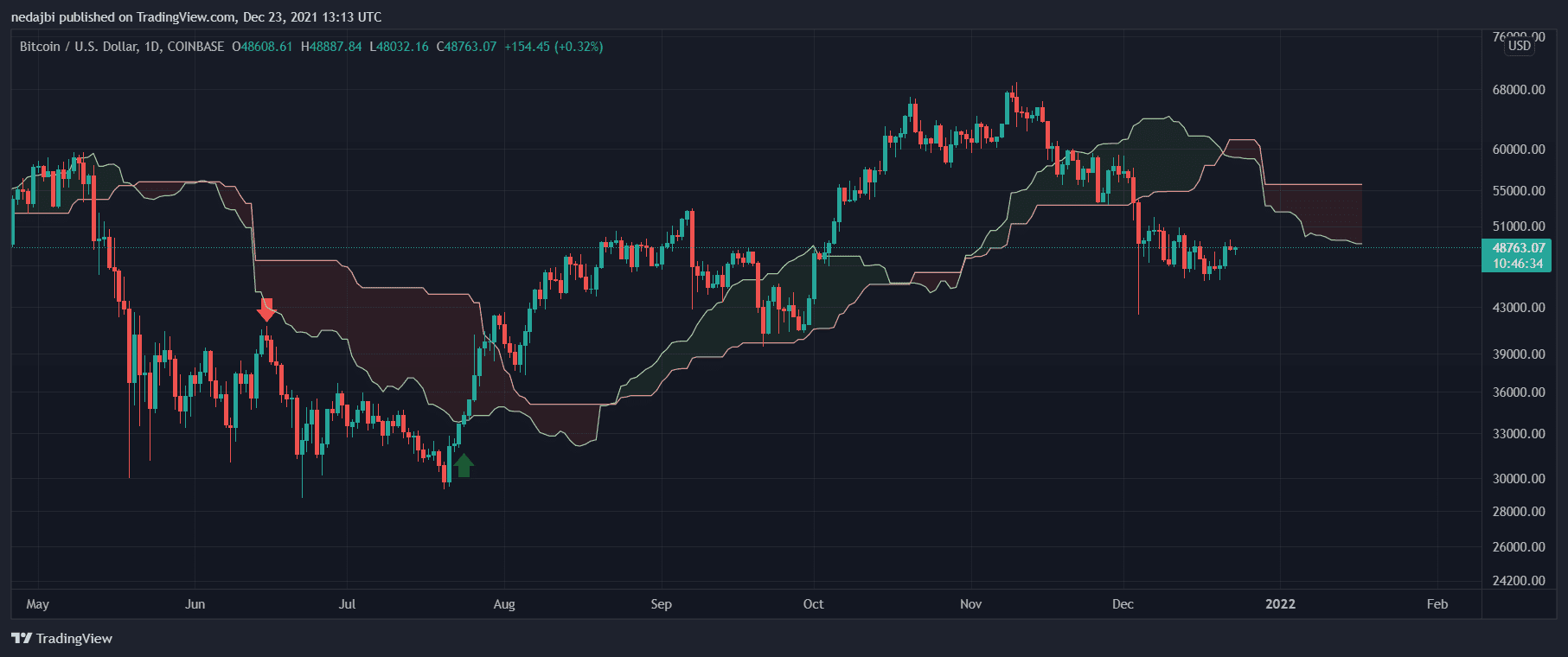

Ichimoku cloud could not act as a support on a daily time frame for Bitcoin on December 4th, so the price dipped around $42.5k. Now, Bitcoin is trading below the Ichimoku cloud, which means the old support becomes new resistance.

A pull-back to the cloud can be expected for the next few days. The question is, after the pull-back is completed, will Bitcoin be able to break out the cloud, like on July 24th, or can lower prices be seen like June 15th, 2021?

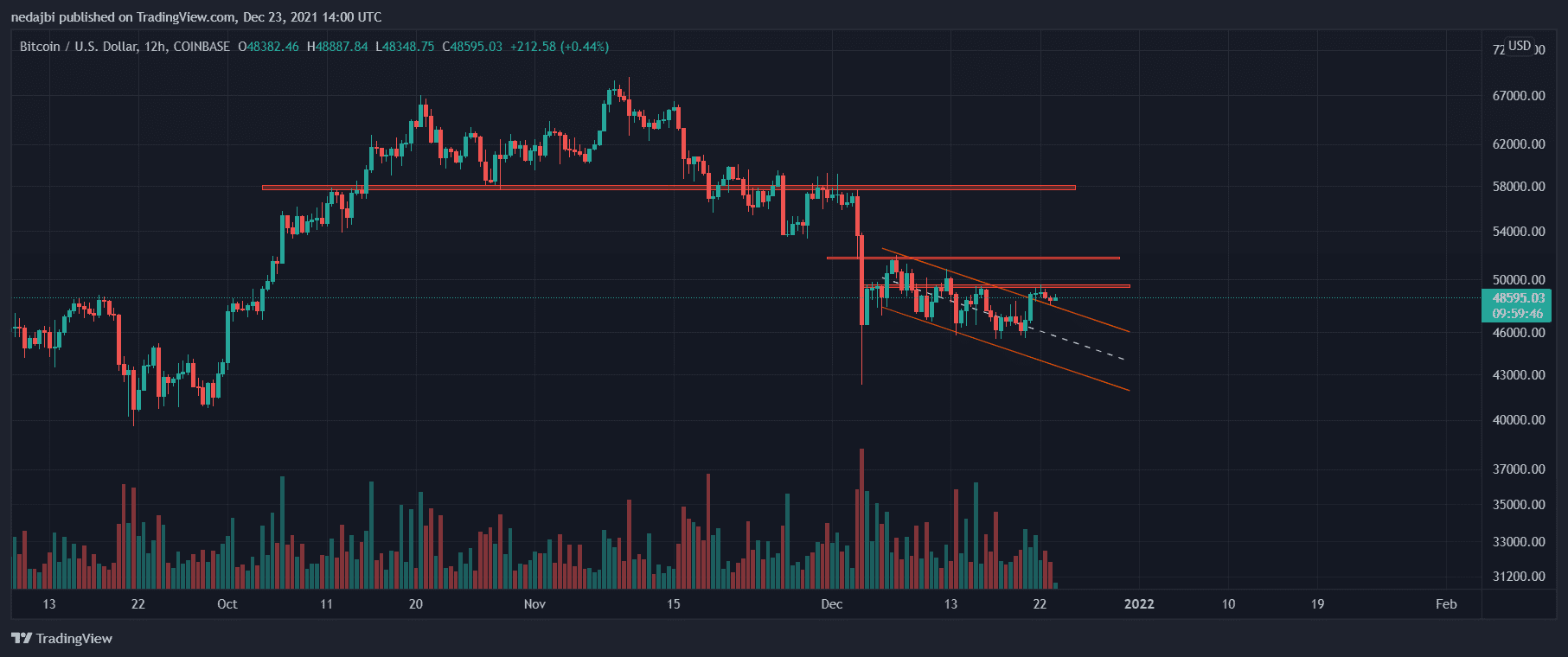

Bitcoin broke the descending channel on a 12-hour time frame, completing the pull-back. It is now trading at $48.6k. The possible resistances are shown in the chart. The $52k level is critical. It seems that Bitcoin still has a hard way to go.

Onchain Analysis

After fluctuating in the $46K-$48K range for the last couple of days, the price has been finally trying to break above $52K.

Meanwhile, the (averaged) Estimated Leverage Ratio across all derivative exchanges is reaching its new ATH. Historically, significant spikes in this metric have led to price volatility, which caused the vast liquidations of the high leveraged futures contract.

The above analysis was complied by @N__E__D__A, and @CryptoVizArt exclusively for CryptoPotato.