MicroStrategy CEO Michael Saylor HODLs $230M Worth Of Bitcoin Privately

Michael Saylor, the founder and CEO of the Nasdaq-listed company MicroStrategy, has revealed that he personally HODLs nearly 18,000 bitcoins.

Additionally, he announced that his company has instituted a new Bitcoin-oriented treasury reserve policy and plans to make further BTC purchases.

Michael Saylor Owns 17,732 Bitcoins

The CEO of MicroStrategy has a somewhat compelling history with Bitcoin. As CryptoPotato reported recently, he said in 2013 that BTC’s days are “numbered.” However, he has completed a one-eighty since then and has been quite bullish on the cryptocurrency in recent months.

The company that he founded more than three decades ago bought a total of 38,250 bitcoins in two batches. This substantial amount represents 0.18% of all bitcoins ever to exist.

Apart from MicroStrategy’s holdings, Saylor disclosed today his own BTC balance.

“Some have asked how much BTC I own. I personally hodl 17,732 BTC, which I bought at $9,882 each on average. I informed MicroStrategy of these holdings before the company decided to buy Bitcoin for itself.” – he tweeted.

To put his Bitcoin holdings into USD perspective, the amount equals $230 million, with BTC’s price trading around $13,000 per coin at the time of this writing.

MicroStrategy’s Bitcoin-Focused Reserve Policy

In a recent interview, Saylor also revealed his company’s Q3 results. Apart from displaying impressive quarterly numbers, MicroStrategy’s CEO announced a compelling new treasury reserve policy that focuses on Bitcoin.

“We have also instituted our new treasury reserve policy, which states that Bitcoin will be the primary treasury reserve asset for the company for capital that exceeds our working capital needs.”

MicroStrategy plans to purchase even more bitcoins as the company generates cash beyond what it needs to run the business of a day-to-day basis.

Millions of (Unrealized) Profit

Having in mind Saylor’s averaged price when he bought his BTC stack, simple math shows that he spent a little over $175 million. As mentioned above, the 17,732 bitcoins now have a value of over $235 million. As such, his profit, should he choose to sell the coins now, would be north of $50 million.

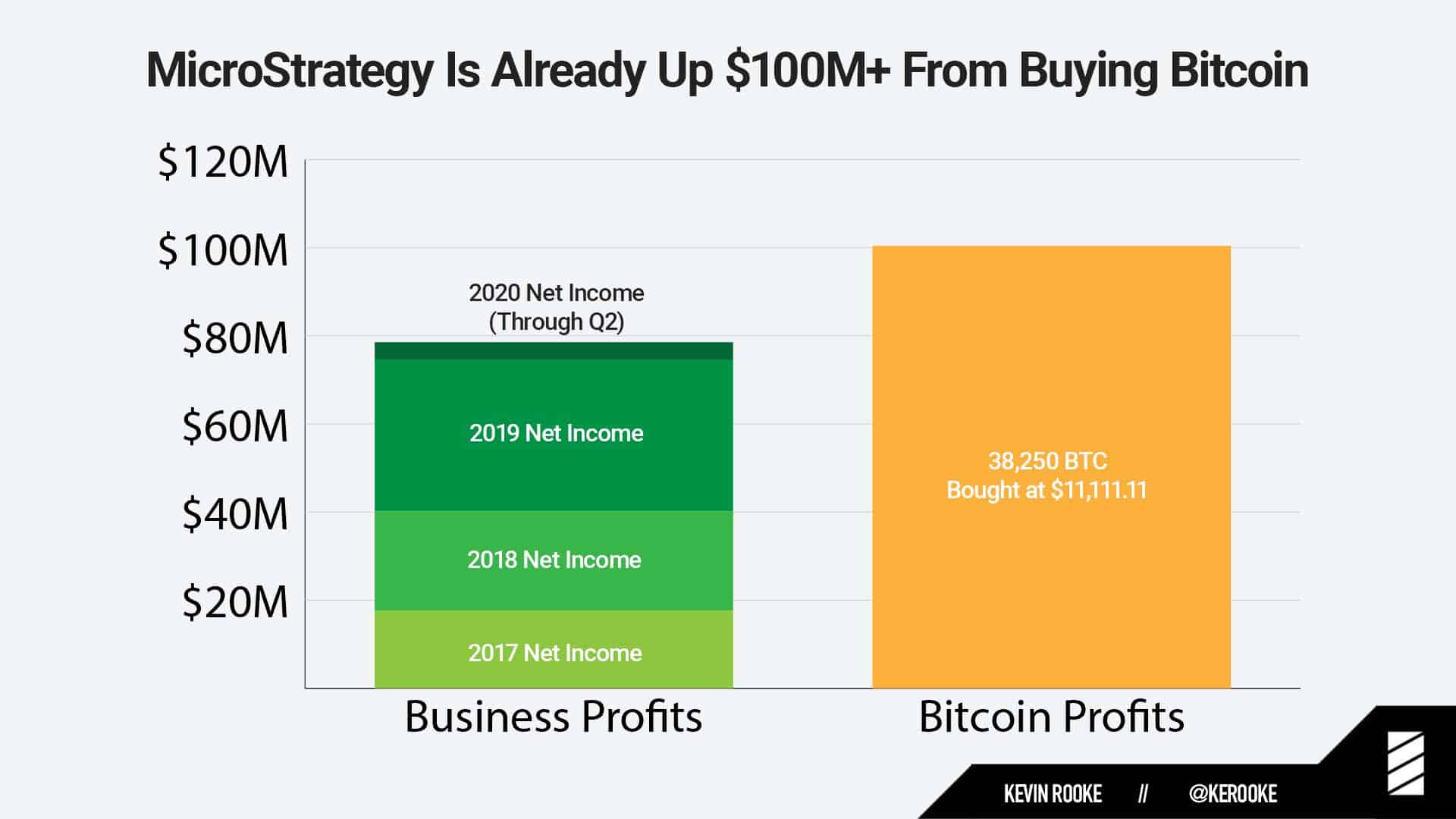

Additionally, a popular cryptocurrency commentator Kevin Rooke brought up similar statistics regarding MicroStrategy’s numbers. He said that the Nasdaq-listed company had earned $78 million in the last three and a half years from their business endeavors. However, if they sell their BTC stack now, their profit will be about $100 million in just two months.

It’s worth noting that to register profit or a financial gain, one has to sell the asset he has previously purchased. Since neither MicroStrategy nor its CEO had actually disclosed selling their Bitcoin holdings, the numbers above provide a hypothetical viewpoint instead of hard numbers.

Featured Image Courtesy of The Business Journals