The Biggest Concern of Bitcoin Investors Until The End Of 2020: Will Trump Get Reelected (Survey)

Bitcoin’s price is undeniably affected by many factors. Throughout its nascent history, it has displayed continuous correlation with the performance of gold, although, at times, it’s moving hand-in-hand with the stock market.

The overall macroeconomic landscape has also proven to be a factor for Bitcoin’s price. For example, it saw a 40% decrease in March when the world declared a state of global pandemic induced by the outbreak of the novel coronavirus COVID-19.

The 2020 US Presidential Elections are closing in on November 3rd, and this is no doubt an event that will have an impact on the world’s economy not only for this year but for the next four.

With all of the above in mind, we at CryptoPotato decided to ask our newsletter subscribers – what would have the highest impact on Bitcoin’s price, as we are getting to the end of 2020?

Trump’s Reelection a Top Concern for BTC Investors

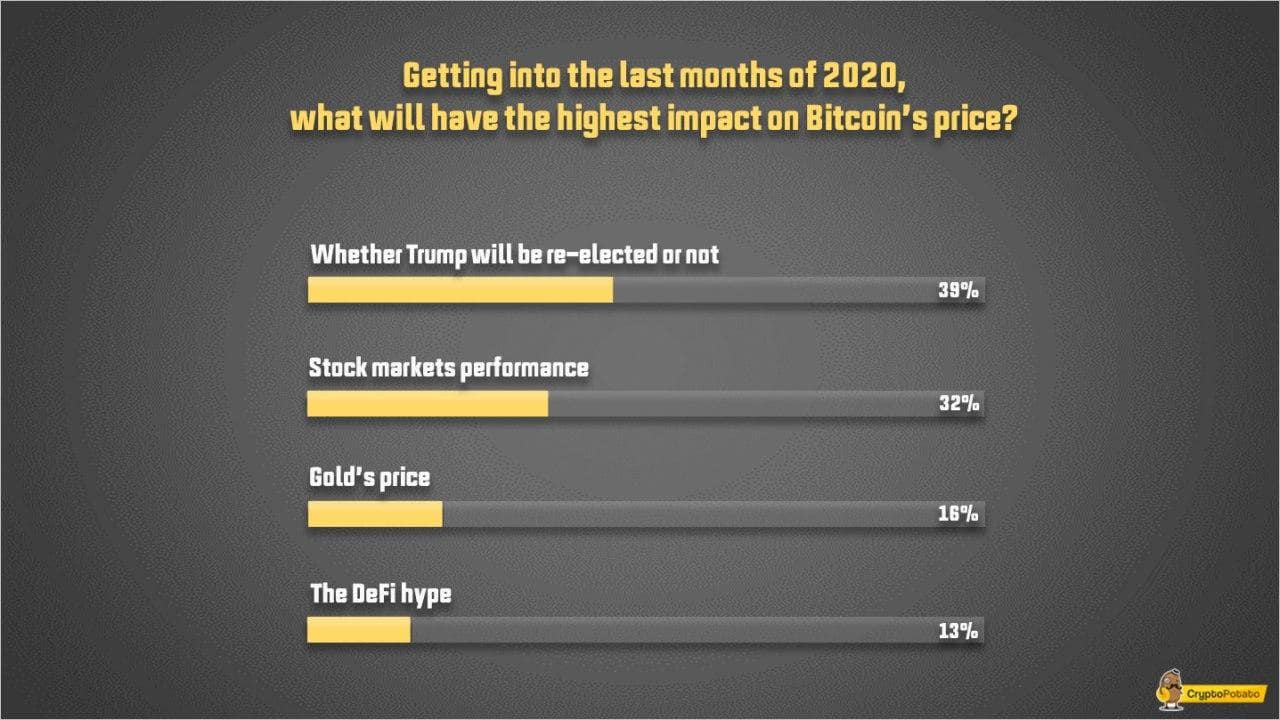

A total of 500 participants took part in our survey. Below is a graphic representation of their answers.

39% of the respondents think that whether Trump gets reelected or not will be the deciding factor for Bitcoin’s price going forward. More interestingly, 20% of all the people who took the survey were Americans, and 43% of them voted for the same answer, giving even more strength to the notion.

32% of participants believe that the stock market’s performance will be a driving factor, while 16% believe gold’s price will have the highest impact on the price of Bitcoin. Only 13% of the respondents voted for the ongoing DeFi hype, which had decreased over the past month.

The results are somewhat unambiguous – investors are concerned with the upcoming elections and the stock market. Those two things, however, are tightly connected, and the stock markets are also likely to react to the outcome of the elections.

Trump: Catalyzing More Increase in Bitcoin’s Price

When trying to figure out what would happen in the future, it’s always a good idea to remind ourselves what happened in the past. For this particular event, we even have a reference point – Trump’s 2016 election.

Donald J. Trump became the 45th President of the United States on Tuesday, November 8th, 2016, after winning the race against his opponent Hillary Clinton.

At the time, Bitcoin was trading at around $700 but almost immediately after the news broke out, the cryptocurrency started increasing. In fact, it managed to gain about 40% by the end of the year, marking an impressive 2-month climb.

It’s unlikely that the elections were the only factor for this move, but it’s also unreasonable to rule them out.

It’s also worth noting that during Trump’s presidency and the outbreak of the novel coronavirus, the Fed issued the COVID19 stimulus packages aimed at helping American citizens and even more so at bailing out large corporations.

This is something that Biden, Trump’s Democratic opponent, has criticized openly on more than one occasion.

During their first Presidential Debate last month, Biden said that “this country (read the US) wasn’t built by Wall Street bankers and CEOs and hedge fund managers. It was built by the American middle class.”

He also said that millionaires and billionaires did very well during the crisis because of the bailouts and the tax cuts. Moreover, he also plans to increase the corporate income tax rate from 21 to 28 percent, should he be elected, as part of his Tax Plan.

These are likely to be developments that Wall Street won’t welcome lightly and could prompt a sell-off or at least a halt to the stock market’s performance. It’s unlikely that this would turn out great for Bitcoin as well.

Featured image courtesy of FT

The post The Biggest Concern of Bitcoin Investors Until The End Of 2020: Will Trump Get Reelected (Survey) appeared first on CryptoPotato.