Why Do Bitcoin Transactions Take So Long to Become “Final” and Can It Be Fixed?

When it comes to the question of mainstream or enterprise adoption of blockchain technology and Bitcoin, much of the discussion tends to focus on barriers such as scalability. However, a valid concern for any organization considering the use of blockchain in transaction processing is that of finality.

You could think of a Bitcoin transaction like the process of a fly becoming trapped in resin. When the transaction is processed, the fly is embedded in the resin. However, the overall process is only considered final once the resin has hardened, and the fly is trapped forever. This takes a certain amount of time – in the case of Bitcoin, around an hour.

The extent of the finality problem in terms of enterprise blockchain adoption cannot be underestimated. In a 2017 paper discussing the use of distributed ledgers in payment, clearing, and settlement infrastructure, the Bank of International Settlements quotes “ambiguity relating to settlement finality” as one of the key risks to adopting blockchain.

The sluggish pace of enterprise blockchain adoption since the paper was published in 2017 indicates that the risk is indeed a valid one.

So, what are the risks posed by blockchain finality in its current state, and how can they be solved?

What is Finality?

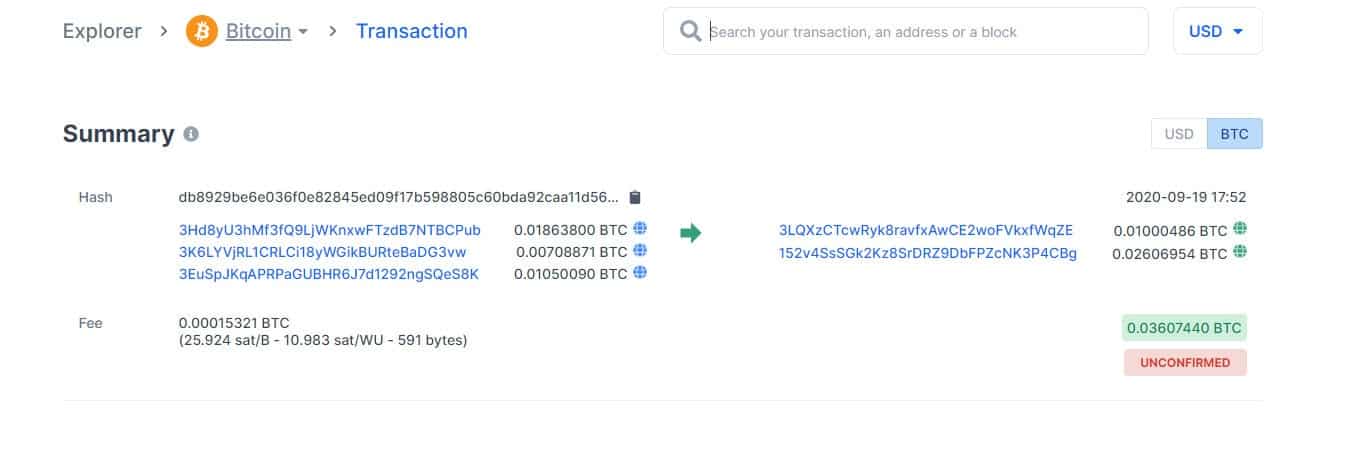

In a traditional Nakamoto-consensus blockchain, transactions are grouped into blocks and undergo a validation process by the network, using the consensus model of the network. In Bitcoin, miners confirm a block, or in a delegated proof-of-stake blockchain such as EOS, the block validators perform a comparable role.

However, confirmation does not mean the transaction is final. Finality is only achieved once the transaction can no longer be canceled or reversed by rolling back or forking the blockchain – once the fly cannot be removed from the resin.

In most blockchains, parties must wait until a certain number of subsequent blocks have been confirmed by the network before the transaction can be deemed final. The further back in the chain that our transaction becomes, the more likely it is that our transaction is in the longest chain of a fork.

This is known as probabilistic finality. Effectively, the transaction is never considered a 100% final. However, as more and more subsequent are confirmed over time, the more difficult or costly it becomes to roll back the blockchain and create a new fork without our transaction in it. Eventually, it becomes prohibitive to undo the transaction.

So the time that it takes to consider a blockchain final also relates to the speed at which the blockchain can process transactions. In Bitcoin, which has a block time of around ten minutes, it takes six blocks, or one hour, for a transaction to be considered final, whereas it’s around 2.5 minutes for Ethereum.

Unacceptable Business Risks

From an enterprise perspective, the time lag involved in probabilistic finality introduces too much vulnerability and ambiguity to a business transaction. As the Bank of International Settlements points out in its paper, there needs to be a legal basis for transaction settlement.

Cosmos’ Tendermint is one example of a consensus model that achieves absolute finality. Any block that achieves a minimum of two-thirds consensus is considered final. However, a critical design challenge of this model is that the network halts if one-third or more validators become unresponsive and fail to validate a block.

Once again, this is unacceptable from an enterprise perspective, as it cannot simply stop doing business due to a dispute over a single transaction.

Finality-as-a-Service

A new enterprise-grade blockchain platform called Concordium is now claiming to offer a solution to the finality challenge. Within its technology stack, it operates a layer that ensures fast and unambiguous transaction finality, via a mechanism called “Finality-as-a-Service.”

The developers at Concordium appear to have solved the conundrum by creating an entirely separate process for finality. While the platform operates a standard Nakamoto-consensus layer that uses proof-of-stake, it runs another layer for finality. Each layer has its own set of validating nodes, with proof-of-stake validators known as “bakers,” and validators on the finality layer known as “finalizers.” Bakers are only permitted to extend the chain beyond the last block that has been finalized by a committee of finalizers.

Any baker holding a minimum required fraction of the overall stake can be included in the finalization committee. This requirement achieves a balance of ensuring that finalization committees are composed of honest stakers, without allowing the committee to become large enough to slow down the finalization process.

Once blocks are validated by bakers, they proceed into the finality layer. If all finalizers agree on the block, it is considered final, and a finalization proof is included in the subsequent block. However, if they don’t agree, the consensus mechanism is designed such that finalizers continue to retry iteratively, looking for a shared common prefixed block, until finalization succeeds.

Concordium also uses sharding, with a central control chain to which shard chains can connect. Each shard runs an individual blockchain, with the central control chain providing “Finality-as-a-Service” to shards. Ultimately, the control chain holds a record of finalized blocks on all shards.

Any entity, such as an enterprise or individual, can launch its own blockchain and connect into Concordium as a private shard. It would mean that they can operate their own consensus algorithm while tapping into Finality-as-a-Service.

Achieving the Right Balance

The net effect is that Concordium achieves an optimal balance between two competing requirements. Transactions can attain a high degree of safety together with fast finality. At the same time, the control chain monitors shards for node uptime and ensures continuing finality, which keeps the network running without interruption.

Concordium is led by teams of developers, entrepreneurs, and industry professionals who understand the challenges of legacy blockchains. Finality is among the most critical of these challenges. By introducing a platform that allows enterprises to finalize transactions in a way that aligned with operational and legal requirements, Concordium may have broken one of the most significant barriers to enterprise adoption.

Click here to start trading on BitMEX and receive 10% discount on fees for 6 months.