Ethereum Mining Revenue Reaches Five Year High

Uniswap’s launch of its native token and associated farming rewards has caused a digital gold rush, which has crippled the Ethereum network for the second time in as many weeks.

The news has been good for Ethereum miners, though, as their revenue has reached a five year high according to on-chain analytics provider Glassnode.

📈 #Ethereum $ETH Miner Revenue (1d MA) just reached a 5-year high of 2,275.790 ETH

Previous 5-year high of 2,273.540 ETH was observed on 02 September 2020

View metric:https://t.co/txQ50SBsFI pic.twitter.com/RWTRP60CJX

— glassnode alerts (@glassnodealerts) September 17, 2020

The mining activity has also pushed Ethereum’s hash rate up to its highest level since October 2018. At the time of writing, the hash rate stands at 254 TH/s, according to Bitinfocharts.com.

Gas Fees Surge With Uniswap Liquidity

The last time the figure surged to such highs was on September 2nd when gas fees reached an all-time high driven by the SushiSwap DeFi food farming frenzy.

This time around, they have been beaten by Uniswap’s UNI airdrop and two-month-long liquidity mining incentive. The pressure on the network has been twofold, firstly those that were airdropped UNI are likely to have sold them for ETH while prices were pumping, and secondly, there was a rush to deposit liquidity into Uniswap’s four new pools.

At the time of writing, those pools have accumulated over $825 million in just over a day since they were launched.

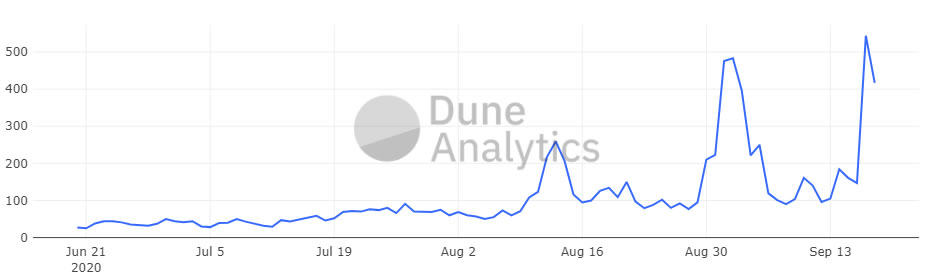

According to Dune Analytics, median gas prices surged to 544 gwei yesterday, which is their highest level ever.

During the height of the UNI mayhem on Thursday, some users were quoting transaction fees in excess of 1000 gwei. Bitinfocharts.com is currently reporting the average cost of an Ethereum transfer as $11. However, this is a lagging indicator, and things appear to be calming down a little in terms of blockchain activity.

Ethereum Price Update

Ethereum prices have also had a boost from all the recent activity, and many prominent members of the crypto community have regarded Uniswap’s yield farming pools as a bullish sentiment for ETH.

ETH prices topped out at a two week high just under $390 a few hours ago. The move added around 7% for the day, and the asset is up roughly 10% on the week.

Since then, they have retreated a little to the $388 zone, but momentum is bullish, and Ethereum could easily make it back above $400 again over the weekend.

Click here to start trading on BitMEX and receive 10% discount on fees for 6 months.