Bullish For Bitcoin Price? Indicators on BTC Futures and Options Turned Green

Bitcoin buy liquidations on BitMEX surpassed twice the volume of sell liquidations. And with aggregated open interest and daily volumes ticking higher, Bitcoin futures markets are looking bullish.

Options markets have not stayed back either on the ‘being bullish’ front.’ Could this mean that traders are going long on BTC? Will the top cryptocurrency make it to $12,000 and higher?

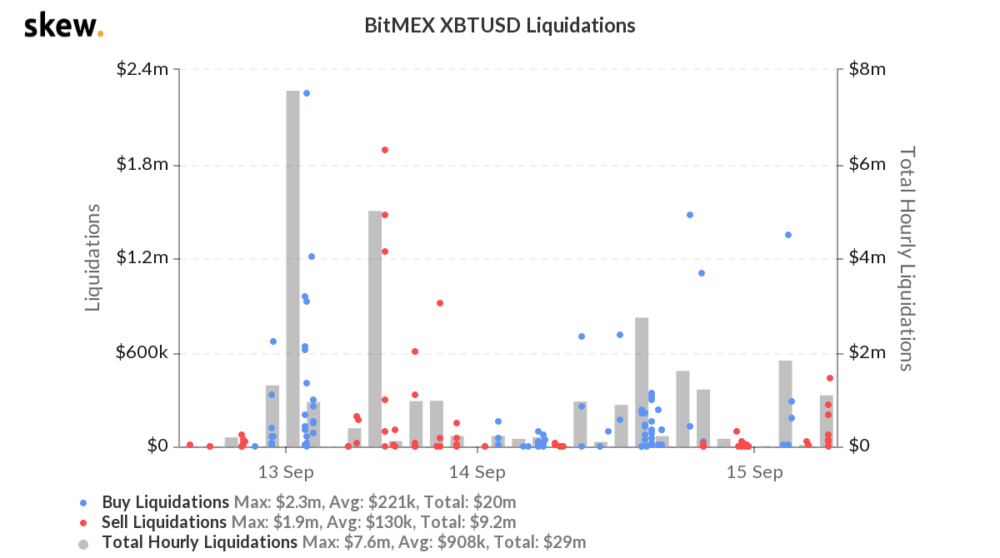

XBTUSD Buy Liquidations Top $20 Million

Futures traders on BitMEX have been flipping long. Data from Bitcoin and cryptocurrency markets analytics firm Skew show this. Buy liquidations/long bets for XBTUSD topped $20 million, as compared to sell liquidations/short bets, which merely made it to $9.2 million.

This may have played a part in Bitcoin’s price pushing upwards through the psychological $10,500 barrier yesterday. Overall, BTC futures markets have galvanized into action as open interest and aggregated daily volumes have posted an uptrend.

After dipping below the $4 billion mark on September 4, open interest for Bitcoin futures touched the $4 billion level back again yesterday.

Daily futures trading volumes surged to $11 billion yesterday after dropping down drastically from $16 billion to $8 billion on the 9th.

Options Traders Call For $36k BTC

Apart from bullish futures trading activity, Skew observed an explosively bullish sentiment amongst Bitcoin options traders.

As per the crypto derivates market observer, amongst all option contracts that traded yesterday, the most active ones were those ‘calling’ for Bitcoin (BTC) price hitting a maximum of $36,000 by the end of the year. Options traders also placed long bets on $28,000 and $32,000 BTC prices, respectively.

Dec20 28k, 32k, 36k calls among the most active #bitcoin options contracts yesterday pic.twitter.com/NO0lytBTTu

— skew (@skewdotcom) September 14, 2020

And according to the latest report that Skew released today, a total of 2000 Bitcoin options contracts that traded yesterday on CME called for BTC prices to hit $11,500, $12,000, and $12,500 by October 20.

It is important to note that under a ‘call’ bet, an options trader can or refuse to buy a particular asset at the predetermined price one or before the set date. He/she is not obliged to make the purchase. The same goes for ‘put’ bets in options trading.

Will Bitcoin Price Surpass the $12,000 Level Again?

As the popular trader and analyst, Crypto Michael noted in a tweet, today, Bitcoin price needs to firmly hold the support at $10,350, with $10,700 being the resistance that needs breaking. BTC already did that in the morning trading session, but what he means is a sustained climb upwards for bullish sentiment.

That’s how an entry into the $11,000-$11,200 zone will become inevitable.

From here, the price will go up or down, as @PostyXBT said earlier today.

That’s great!

In resistance zone. Crucial area to hold at $10,350. Crucial resistance to break is $10,700.

Breakout up and we’ll target $11,000-11,200. pic.twitter.com/11D0xUOIgW

— Crypto Michaël (@CryptoMichNL) September 15, 2020

Josh Rager is ‘leaning bullish’ as he pointed out that BTC has continuously closed above the $9940-10,173 level for two weeks now. He wants to see Bitcoin tap the near $12,000 level of $11,900 to flip bullish.

The effects of the derivatives markets often trickle into spot markets. Historically, this has been the case for Bitcoin. From the way it looks, bullish futures, and options trading activity could reflect in the spot trading scenario as well, perhaps leading BTC to hit $12,000.

Binance Futures 50 USDT FREE Voucher: Use this link to register & get 10% off fees and 50 USDT when trading 500 USDT (limited – first 200 sign-ups & exclusive to CryptoPotato).

Click here to start trading on BitMEX and receive 10% discount on fees for 6 months.