After seven weeks, XRP managed to push back above $0.4, but the bears were quick to push the price back below it. In order for the bullish structure to remain valid, the bulls must not allow the price to go below $0.33.

Technical Analysis

By Grizzly

The Daily Chart

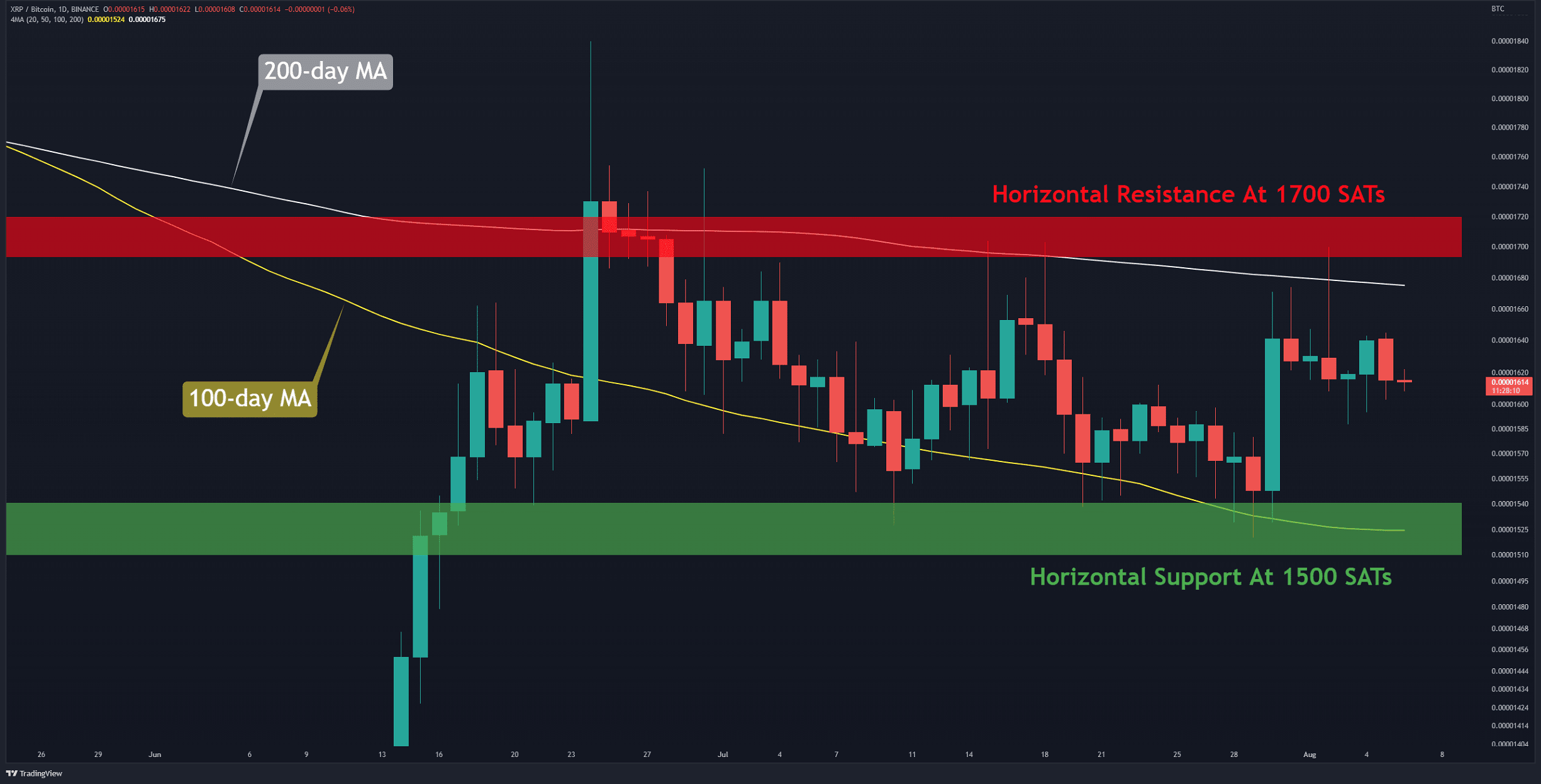

The bullish structure resulting from the formation of higher highs and higher lows is visible in the following chart. Late last week, the bulls succeeded in their third attempt to break the resistance zone in the $0.37-$0.39 range (in yellow). This extended the price towards the 100-day moving average (in white), although it was not reached or surpassed.

The bears defended this level, resulting in a fake breakout appearing on the chart. The pair is currently trading below the resistance zone, and the MA100 is approaching this level.

The bullish structure would be even stronger if the bulls can push XRP above $0.41. A break and close above this resistance would signal the start of a rally with a target of $0.5. By contrast, if buyers fail to impede the recent decline above $0.33, the bullish structure would be invalidated.

Key Support Levels: $0.33 & $0.30

Key Resistance Levels: $0.39 & $0.41

Daily Moving Averages

MA20: $0.36

MA50: $0.34

MA100: $0.40

MA200: $0.57

The XRP/BTC Chart

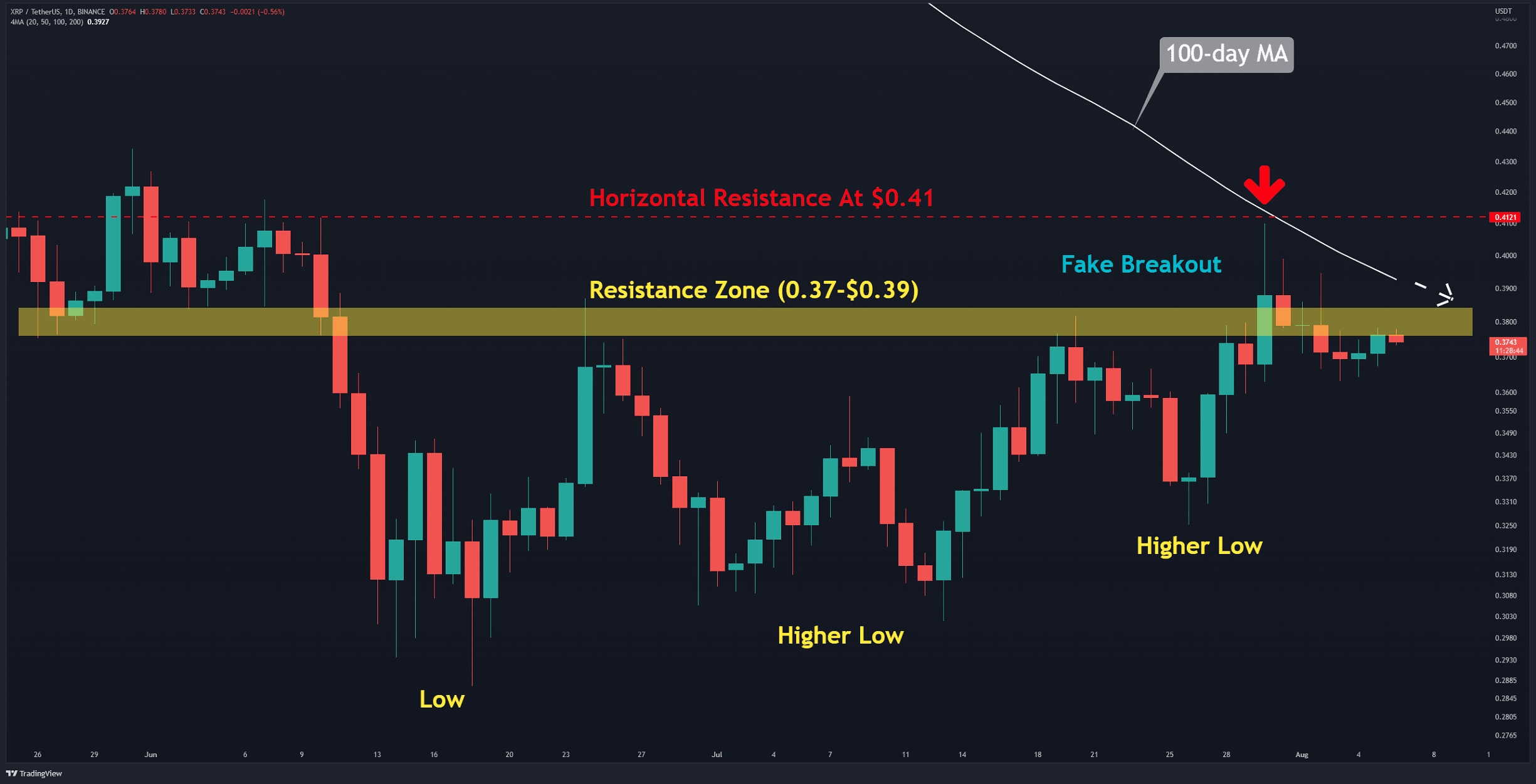

Against BTC, the cryptocurrency is fluctuating between the 100-day moving average from the down-side (in yellow) and the 200-day moving average from the up-side (in white). This has caused the price to range between two support and resistance zones ranging from 1500 SATs (in green) to 1700 SATs (in red). No significant movement can be expected until the price breaks out of this tight range-bound.

Key Support Levels: 1500 SATs & 1370 SATs

Key Resistance Levels: 1700 SATs & 2100 SATs